David Whitcombe of Chief Equity Analyst at LINK FOREX Analysis: Heightened Uncertainty Draws Market Attention as U.S. Equities Continue to Follow Fundamental Trends

London, United Kingdom, Jan. 25, 2026 (GLOBE NEWSWIRE) -- Recent developments in the global macro environment have brought renewed attention to policy-related uncertainty, prompting increased discussion across financial markets. Such developments have contributed to a short-term rise in market volatility, leading to temporary fluctuations in U.S. equity prices.

David Whitcombe, Chief Market Strategist at LINK FOREX, notes that the impact of these developments is primarily reflected in elevated risk premiums over the short term, rather than any meaningful change in the medium- to long-term trajectory of U.S. equities. According to Whitcombe, markets are currently pricing uncertainty itself rather than specific outcomes, with sentiment and trading rhythm affected more than overall trend direction.

From an index perspective, major U.S. benchmarks experienced brief pullbacks and increased volatility during the news cycle, yet remained within established trading ranges.

Whitcombe commented, “These short-term market corrections do not represent a structural shift or a trend-level breakout. Equity pricing continues to be anchored by corporate earnings visibility and prevailing liquidity conditions.”

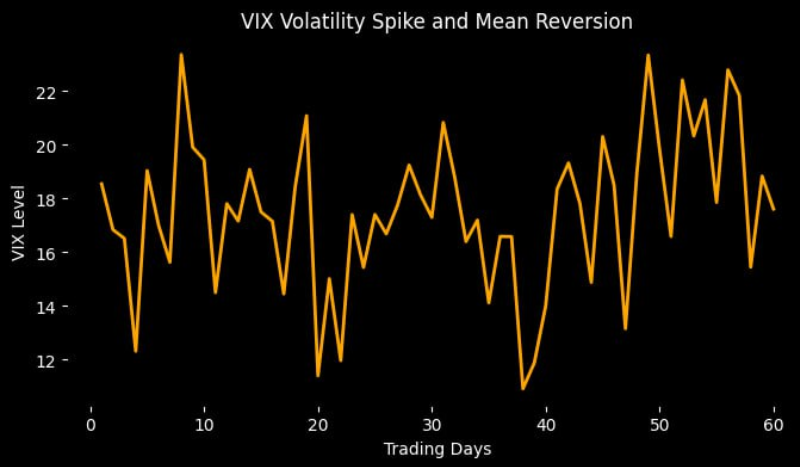

The volatility index registered a noticeable increase following the news flow, reflecting heightened short-term risk awareness among investors, though it remains within its historical mid-range. Whitcombe explained that the rise in volatility reflects prudent risk management behavior rather than systemic risk aversion.

“This environment reflects increased hedging activity and position adjustments,” he said. “It is a classic case of heightened price volatility rather than a change in market direction.”

In the immediate aftermath, U.S. equities experienced intraday swings, volatility measures temporarily spiked, and short-term positioning in risk assets adjusted accordingly. However, Whitcombe emphasized that these moves were not accompanied by material changes in corporate earnings expectations or broader macroeconomic fundamentals.

When uncertainty rises, markets typically respond by reducing exposure and reassessing risk, rather than repricing long-term value. Structural analysis conducted by LINK FOREX indicates no evidence of large-scale institutional capital withdrawal from U.S. equities. Current data show no significant downward revisions to earnings expectations, no notable deterioration in market liquidity, and no signs of systematic long-term capital flight.

Instead, recent capital flows suggest internal rotation within the equity market. Funds have shifted away from highly valued, sentiment-driven stocks toward companies characterized by stable cash flows and strong balance sheets, resulting in a temporary premium for defensive and lower-volatility assets.

“This should be viewed as a recalibration of risk pricing rather than a rejection of the market,” Whitcombe noted.

From a medium-term perspective, policy-related and macro developments may disrupt market rhythms temporarily but are unlikely to alter the underlying direction of U.S. equities. Whitcombe emphasized that the key drivers of medium-term market performance remain unchanged:

Corporate earnings cycles

Interest rates and liquidity conditions

Capital allocation dynamics and risk appetite

While external developments can amplify short-term volatility, sustained changes in earnings, funding costs, or liquidity are required to drive lasting trend shifts. Under LINK FOREX’s baseline outlook, U.S. equities remain in a phase characterized by high differentiation, lower tolerance for execution errors, and an increased emphasis on stock selection. Broad, one-directional index movements are becoming more difficult to sustain.

Whitcombe concluded, “A defining feature of a mature market is not the absence of uncertainty, but the ability to distinguish short-term noise from structural signals. At this stage, U.S. equities are testing risk tolerance rather than the direction of the trend itself.”

CONTACT: Media Contact LINK FOREX LTD: stock@link-forex.com FOREX FUSION LTD: trading@forex-fusion.com Contact: David Whitcombe Company Name : LINK FOREX LTD Website: https://www.link-forex.com/ Email: stock@link-forex.com