Trends and Investments in Fiberboard Packaging Market 2025-35

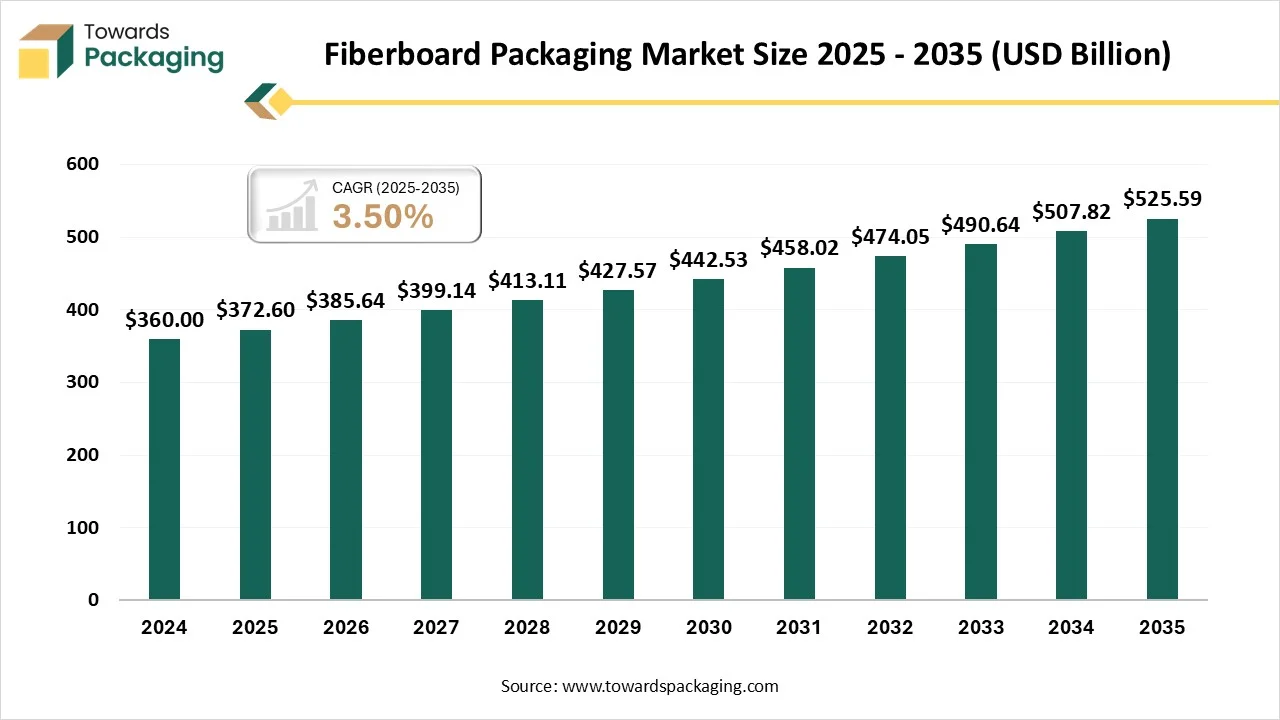

According to a recent analysis by Towards Packaging, the global fiberboard packaging market is projected to expand from USD 385.64 billion in 2026 to USD 525.59 billion by 2035, recording a CAGR of 3.5% between 2025 and 2034.

Ottawa, Jan. 09, 2026 (GLOBE NEWSWIRE) -- The global fiberboard packaging market size was recorded at USD 372.60 billion in 2025 and is forecast to increase to USD 525.59 billion in 2035, as per findings from a study published by Towards Packaging, a sister firm of Precedence Research. The market is growing due to rising demand for sustainable, lightweight, and cost-effective packaging solutions across the food, e-commerce, and consumer goods industries.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Private Industry Investments for Fiberboard Packaging:

- Sustana Group (Acquired by Blackstone): In late 2021, a private equity firm, Blackstone Tactical Opportunities, acquired Sustana Group, a manufacturer of specialty recycled fiber and sustainable packaging and paper products, from another private equity firm, H.I.G. Capital.

- Pixelle Specialty Solutions (Acquired by H.I.G. Capital): H.I.G. Capital, a private equity firm, announced the acquisition of Pixelle Specialty Solutions in April 2022. Pixelle is a leading manufacturer of specialty papers, which are integral to various packaging solutions.

- Oji India Packaging Private Limited (Oji Holdings Corp. subsidiary): Oji Holdings Corporation, a major global paper and packaging group, has made significant private investments in expanding its fiberboard and corrugated box manufacturing facilities in India, including a new factory in Sri City in 2024.

- Graphic Packaging Holding Co. (Significant Investor : Clayton Dubilier & Rice): While Graphic Packaging is a publicly traded company, the private equity firm Clayton Dubilier & Rice has been a significant investor, influencing its growth in the fiber-based consumer packaging solutions market.

- Fibmold (Seed funding from Accel, Omnivore, and others): Fibmold, an Indian company founded in 2022, is a private entity that received Series A funding to provide sustainable packaging solutions, specifically molded fiber products made from natural fibers like bamboo and bagasse, which are alternatives to traditional fiberboard applications.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5823

Key Technological Shifts

- Adoption of high-strength lightweight fiberboard to reduce material usage and transportation costs

- Increased use of recycled and bio-based fibers to improve sustainability and circularity

- Advanced digital and flexographic printing for better branding and customization

- Development of moisture-resistant and barrier-coated fiberboard for food and fresh produce packaging

- Automation and smart manufacturing to enhance production efficiency and consistency

Market Overview

The fiberboard packaging market is witnessing steady growth driven by the growing need for recyclable and environmentally friendly packaging options. Market expansion is being supported by rising use in the consumer goods e-commerce and food and beverage industries. Fiberboard is a popular packaging material because of its lightweight qualities, affordability, and printability. Technological developments and governmental backing for environmentally friendly packaging bolster market expansion.

Market Opportunities

- Growing demand for eco-friendly and plastic-free packaging across industries

- Expansion of e-commerce is driving the need for durable and lightweight shipping boxes

- Rising use of recycled fiberboard to support circular economy goals

- Increasing adoption in food & beverage packaging due to safety and sustainability benefits

- Customization and premium printing create value-added packaging opportunities

- Growth in ready-to-eat and takeaway food is boosting demand for protective fiberboard solutions

- Emerging markets are adopting organized retail and modern packaging formats

Segmental Insights

By Product Type

The corrugated single-wall segment dominated the fiberboard packaging market, driven by its board sustainability for general-purpose packaging affordability and lightweight design because of its sufficient strength, ease of recycling, and effective stackability. It is widely used in consumer goods, food, and industrial applications. Manufacturers' widespread adoption is further aided by its compatibility with high-speed packaging lines.

The corrugated double-wall segment is growing rapidly, driven by the growing need for robust, high-protection packaging options. It is perfect for bulk shipping distance transportation, and fragile goods because of its improved durability and load-bearing capacity. The need for double-wall fiberboard packaging is increasing due to increased international trade and cross-border logistics.

By Grade

The recycled fiberboard testliner segment dominated the fiberboard packaging market, driven by stringent sustainability laws and an increase in packaging manufacturers' use of recycled materials. Its widespread availability, advantages for the environment, and cheaper production costs all contribute to its dominance. The use of testliners is increasing across industries because of growing corporate commitments to lower-carbon techniques.

The virgin fiberboard kraft paper segment is growing rapidly, driven by the growing demand for premium food-safe high strength packaging. It is appropriate for high-end applications due to its exceptional tear resistance and clean surface quality. The market is expanding due to consumers' growing desire for aesthetically pleasing and contamination-free packaging.

By Packaging Type

The slotted boxes segment dominated the fiberboard packaging market, motivated by its adaptability, simplicity of customization, and economic production method. These boxes are frequently used in many different industries for distribution, shipping, and storage. Large-scale deployment is supported by their capacity to be manufactured in a variety of sizes with little material waste.

The folding cartons segment is growing rapidly, driven by the growing need for packaging that is aesthetically pleasing, lightweight, and space efficient. Growing use of branded retail-ready consumer packaging supports growth. Adoption is being further boosted by developments in digital printing and design personalization.

By Application

The food and beverages segment dominated the fiberboard packaging market, driven by the need for safe, hygienic packaging and the high consumption of packaged foods. Effective protection, moisture resistance, and regulatory compliance are all provided by fiberboard. Additionally, food producers' and retailers' sustainability objectives are well aligned with its recyclable nature.

The e-commerce and retail segment is growing rapidly, driven by the need for robust transit packaging and the increase in online shopping. Last-mile delivery and returns management are two common uses for fiberboard. This market is adopting eco-friendly shipping materials more quickly due to increased attention to them.

By End User

The manufacturers segment dominated the fiberboard packaging market, driven by high usage for outbound shipments, internal logistics, and product storage. Packaging made of fiberboard facilitates cost control and effective handling. Large manufacturing facilities favor it because of its automation adaptability.

The e-commerce companies segment is growing rapidly, driven by the quick growth of online retail platforms and an increase in package shipments. During transit, fiberboard packaging guarantees product safety. Growth is also fueled by the demand for returnable brand-friendly and customized packaging options.

More Insights of Towards Packaging:

- Edible Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Corrugated Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Cosmetic Packaging Market Trends, Size, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis 2024-2035

- Pet Food Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Green Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Glass Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Seafood Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Aluminium Foil Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Tobacco Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Insulated Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Automated Bagging Solutions Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Automotive Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Frozen Food Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Smart Packaging Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Analysis, 2025-2035

- Intelligent Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Reusable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- E-Commerce Packaging Market Size, Share, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Analysis 2025-2035

- Pharmaceutical Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Flexible Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Recyclable Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

By Geography

Asia Pacific in Command: Dominance of the Fiberboard Packaging Industry Driven by Manufacturing Scale and E-commerce Growth

The Asia Pacific region is dominating the market, driven by strong e-commerce growth, growing manufacturing, and quick industrialization. Large-scale packaging consumption is supported by high population density. Regional demand for sustainable packaging is further strengthened by government initiatives.

China Fiberboard Packaging Market Trends

China’s market is experiencing strong growth as manufacturers and brand owners increasingly adopt sustainable and recyclable materials to meet environmental regulations and evolving consumer preferences for eco-friendly packaging. Demand is driven by rapid expansion in e-commerce, logistics, electronics, food and beverage, and consumer goods sectors, where fiberboard offers lightweight yet durable protection during transportation and storage.

North America on the Fast Track: Fastest Growth in the Fiberboard Packaging Industry Fueled by Sustainable Packaging Demand

The North America region is growing rapidly, fueled by a growing emphasis on advanced logistics infrastructure and recyclable packaging. Market expansion is supported by robust demand from the food, beverage, and internet retail industries. Fiberboard adoption is accelerating throughout the region due to growing consumer demand for environmentally friendly packaging options.

Canada Fiberboard Packaging Market Trends

Canada’s market is expanding steadily as businesses and manufacturers increasingly prioritize sustainable, recyclable, and lightweight packaging solutions to meet rising environmental expectations and regulatory pressures. Demand is being driven by strong e-commerce growth, particularly in retail, food and beverage, electronics, and consumer goods sectors, where fiberboard’s durability and protective qualities are valued for shipping and storage.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments in the Fiberboard Packaging Industry

- In September 2025, Smurfit Westrock launched the Bag-in-Box Powergrip. The packaging solution is an innovative fiber-based solution designed to replace rigid plastic containers for liquids and semi-liquids.

- In November 2025, DS Smith launched a new range of 100% recyclable cardboard buffers designed to protect industrial machinery components. DS Smith is offering a sustainable alternative to plastic foam (EPS), which can reduce storage space by 60%.

Top Companies in the Fiberboard Packaging Market & Their Offerings:

- Smurfit Westrock: The world's largest sustainable paper-based packaging company, formed by the 2024 merger of Smurfit Kappa and WestRock.

- International Paper Company: A global leader in sustainable packaging that significantly expanded its European footprint by acquiring DS Smith in early 2025.

- Mondi Group: A leading producer of integrated corrugated and flexible packaging, noted for its 2025 acquisition of Schumacher Packaging to bolster its food industry portfolio.

Other Players

- Oji Holdings Corporation

- DS Smith (subsidiary of International Paper )

- Packaging Corporation of America (PCA)

- Nine Dragons Paper Holdings

- Rengo Co., Ltd.

- Georgia-Pacific LLC

- Huhtamäki Oyj

- Metsä Board

- Mayr-Melnhof Karton

- Pratt Industries

- Billerud AB

Segments Covered in the Report

By Product Type

- Corrugated Fiberboard

- Single Wall

- Double Wall

- Triple Wall

- Solid Fiberboard

- Composite Fiberboard

- Others

By Grade

- Virgin Fiberboard

- Kraft Paper-based

- Bleached Paperboard

- Recycled Fiberboard

- Testliner

- Chipboard

By Packaging Type

- Boxes & Cartons

- Slotted Boxes

- Rigid Boxes

- Folding Cartons

- Trays

- Inserts & Dividers

- Pallets & Bulk Containers

- Others

By Application

- Food & Beverages

- Consumer Goods

- Healthcare & Pharmaceuticals

- Electronics & Electricals

- Industrial Goods

- E-commerce & Retail

- Others

By End User

- Manufacturers

- Retailers & Wholesalers

- Logistics & Transportation Companies

- E-commerce Companies

- Others

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5823

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Pharmaceutical Temperature Controlled Packaging Solutions Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Rigid Plastic Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Protective Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- AI in the Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Eco-friendly Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Ampoules Packaging Market Size, Segments, Regional Data and Competitive Insights (2025-2035)

- 3D Rendering Market Size, Segment Data, Regional Insights, Companies, Value Chain & Trade Analysis (2025-2035)

- Packaging Robots Market Size, Segments Data, Regional Insights, Trade Flows and Industry Players

- Luxury Rigid Box Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Barrier Coatings for Flexible Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Pharmaceutical Packaging Laminates Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Diaper Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Flexible Paper Packaging Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis (2025-2035)

- Alcoholic Beverage Glass Packaging Market Size, Trends, Regional Insights (NA, EU, APAC, LA, MEA), Segments, Competitive Landscape, and Trade Analysis Report 2025-2035

- Dietary Supplement Packaging Market Size, Trends, Segments, Regional Analysis (NA, EU, APAC, LA, MEA), Manufacturers, Competitive Landscape & Value Chain Insights

- Wafer Level Packaging Market Size, Trends, Segmentation, Regional Outlook, and Competitive Landscape Analysis

- Plantable Packaging Market Insights, Forecast and Competitive Strategies

- Cardboard Boxes Market Size, Trends, Segments, Regional Outlook, and Competitive Analysis Report 2025-2035

- Cardboard Sheet Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape, and Trade Analysis 2025-2035