Ophthalmic Drugs Market Size to Cross USD 62.74 Billion by 2032, Driven by Advances in Eye Care Treatments and Rising Global Vision Disorders - SNS Insider

SNS Insider Projects U.S. Ophthalmic Drugs Market Growth from USD 14.06 Billion in 2023 to USD 23.11 Billion by 2032, Supported by Strong R&D Investments and Rising Incidence of Eye Disorders.

Austin, Texas, Dec. 07, 2025 (GLOBE NEWSWIRE) -- Ophthalmic Drugs Market Size & Growth Outlook

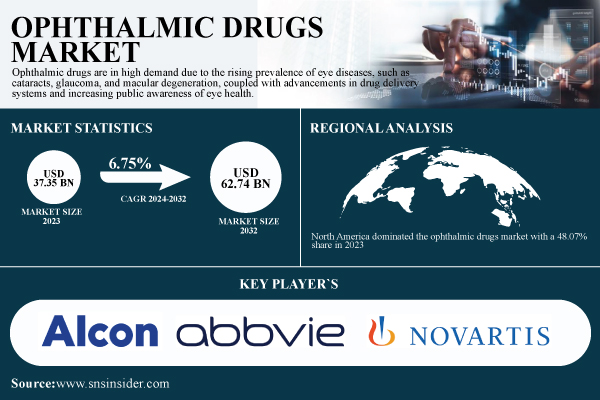

According to SNS Insider, The Ophthalmic Drugs Market size was valued at USD 37.35 billion in 2023 and is projected to reach USD 62.74 billion by 2032, growing at a CAGR of 6.75% during 2024-2032. The increasing incidence of eye conditions including cataracts, glaucoma, and macular degeneration, along with improvements in drug delivery methods and growing public awareness of eye health, have led to a surge in demand for ophthalmic medications.

Get a Sample Report of Ophthalmic Drugs Market: https://www.snsinsider.com/sample-request/6861

The U.S. ophthalmic drugs market valuation was USD 14.06 billion in 2023 and is expected to reach USD 23.11 billion by 2032, growing at a CAGR of 6.46% during 2024-2032. Due to its advanced healthcare system, high healthcare costs, and high prevalence of eye conditions, the United States dominates the North American market for ophthalmic medications.

Key Ophthalmic Drugs Companies Profiled in the Report

- AbbVie

- Alcon Vision

- Bausch Health Companies

- Bayer

- Coherus BioSciences

- F. Hoffmann La Roche

- Novartis

- Pfizer

- Regeneron Pharmaceuticals

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

- Additional market participants

Ophthalmic Drugs Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 37.35 Billion |

| Market Size by 2032 | USD 62.74 Billion |

| CAGR | CAGR of 6.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Segments | • By Class (Anti-allergy, Anti-inflammatory, Non-steroidal Drugs, Steroidal Drugs, Anti-VEGF Agents, Anti-glaucoma, Others) • By Disease (Dry Eye, Allergies, Glaucoma, Infection, Retinal Disorders, Uveitis, Others) • By Route of Administration (Topical, Local Ocular, Systemic) • By Dosage Form (Gels, Eye Solutions & Suspensions, Capsules and Tablets, Eye Drops, Ointments) • By Product Type (Prescription Drugs, OTC) • By Drug Type (Branded Drugs, Generic Drugs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Nanotechnology-based Ocular Drug Delivery Systems are Propelling Market Expansion Globally

The carriers delay release, improve solubility and stability, lessen side effects, and transport medications to the site of action. This method has gained attention in the last 20 years as a possible way to get around ocular barriers and boost medication absorption. The FDA has approved a few nanocarriers that are currently on the market for use in the therapeutic treatment of eye conditions. According to the WHO, more than 2.2 billion people have some degree of near or distance vision impairment globally. Importantly, at least 1 billion of these instances, nearly 50%, were preventable or remain to be treated.

Stringent Regulatory Approval Processes May Impede Market Expansion

The Food and Drug Administration (FDA), which oversees the clearance of medical devices in the U.S., has repeatedly come under fire for its regulatory procedures, notably for instances of delays and longer processing times in comparison to other developed countries. Medical device approvals in Japan are governed by the Pharmaceutical and Medical Devices Agency (PMDA), which uses procedures and evidentiary requirements that are very similar to those of the FDA.

Segmentation Analysis:

By Class

In 2023, the Anti-VEGF agents segment held the dominant ophthalmic drugs market share of 32.15% as these agents operate by preventing the action of Vascular Endothelial Growth Factor (VEGF), a protein that causes the abnormal development of blood vessels. Anti-glaucoma is anticipated to exhibit the fastest growth throughout the forecast period as anti-glaucoma medications are given either orally or topically, each mode having unique side effect profiles.

By Disease

The retinal disorder segment dominated the market with a 36.11% share in 2023 due to the changing lifestyle, aging, and the prevalence of chronic diseases. Infection segments are anticipated to experience the fastest growth over the forecast period, as ophthalmic anti-infectives are medications specifically formulated for application or instillation into the eye to treat ocular infections.

By Route of Administration

The topical segment dominated the market with a 64.13% share in 2023. The segment’s dominance is attributed to the ability of topically applied ophthalmic medication to penetrate intraocular tissues along three major pathways, direct corneal, aqueous humor, and vitreous body penetration. The local ocular segment is expected to experience the fastest growth over the forecast period as local ophthalmic drugs are medications administered directly to the eye.

For a Personalized Briefing with Our Industry Analysts, Connect Group Now: https://www.snsinsider.com/request-analyst/6861

By Dosage Form

In 2023, the eye drops segment led the ophthalmic drugs market with 68.46% total share as it is widely used, easy to administer, and its action sets in quickly to treat multiple eye diseases, including dry eye, glaucoma, infections, and allergies. The Eye Solutions & Suspensions segment is anticipated to exhibit the fastest growth over the forecast period due to its direct administration of therapeutic drugs to the action site, which enables a greater localized concentration than is normally obtained by oral administration.

By Product Type

The prescription drug segment led the ophthalmic drug market with a 75.10% total share in 2023, owing to its critical position in the management of serious and vision-risking eye diseases, including glaucoma, age-related macular degeneration, and diabetic retinopathy. OTC drugs are expected to witness the fastest growth over the forecast period as the over-the-counter (OTC) medications are readily available as they can be bought without a prescription from a health expert.

By Drug Type

The branded drug segment dominated the ophthalmic drugs market with an 85.12% share in 2023 as these drugs undergo rigorous testing to ensure quality, safety, and efficacy, providing physicians and patients with more assurance in their usage (FDA – Ophthalmic Drugs).

Regional Insights:

North America dominated the ophthalmic drugs market with a 48.07% share in 2023 owing to its advanced healthcare infrastructure, huge healthcare spending, and well-developed pharmaceutical industry. Asia Pacific is anticipated to exhibit the fastest growth with 7.41% CAGR over the forecast period in the ophthalmic drugs market. The region is witnessing a swift growth in the aging population, which results in an increased prevalence of age-related eye diseases.

Recent Developments:

- March 2024 – Roche Pharma India brought Vabysmo to the Indian market, a cost-effective therapy for neovascular age-related macular degeneration and diabetic macular edema. Roche is collaborating with the government and insurance companies to increase access for patients. Worldwide, Vabysmo has achieved robust sales and provides long-lasting benefits against retinal vision loss.

- June 30, 2023 – Novartis will divest its 'front of eye' ophthalmology assets to Bausch + Lomb for up to USD 2.5 billion. The transaction entails Xiidra, SAF312 (libvatrep), the AcuStream delivery device, and OJL332.

Purchase Single User PDF of Ophthalmic Drugs Market Report: https://www.snsinsider.com/checkout/6861

Exclusive Sections of the Report (The USPs):

- DISEASE INCIDENCE & PREVALENCE METRICS – helps you understand the global burden of eye disorders and identify high-risk regions where demand for ophthalmic drugs is accelerating.

- REGIONAL PRESCRIPTION TRENDS ANALYZER – helps you track how treatment preferences differ across regions, enabling insights into dominant therapies and shifting prescribing behavior.

- HEALTHCARE SPENDING LANDSCAPE – helps you assess investment patterns across government, commercial, private, and out-of-pocket payers, revealing affordability, access, and market depth.

- NEW DRUG CLASS PENETRATION INDEX – helps you evaluate adoption rates of emerging drug categories, such as biologics, sustained-release formulations, and gene-therapy-linked innovations.

- THERAPEUTIC OPPORTUNITY MAPPING – helps you identify under-served disease segments, unmet clinical needs, and high-growth areas in retinal disorders, glaucoma, dry eye, and infection management.

- COMPETITIVE PIPELINE & INNOVATION SCORECARD – helps you gauge the strength of market players based on late-stage pipelines, regulatory approvals, and innovation intensity.

Related Reports

Ophthalmic Diagnostic Devices Market

Ophthalmic Clinical Trials Market

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com