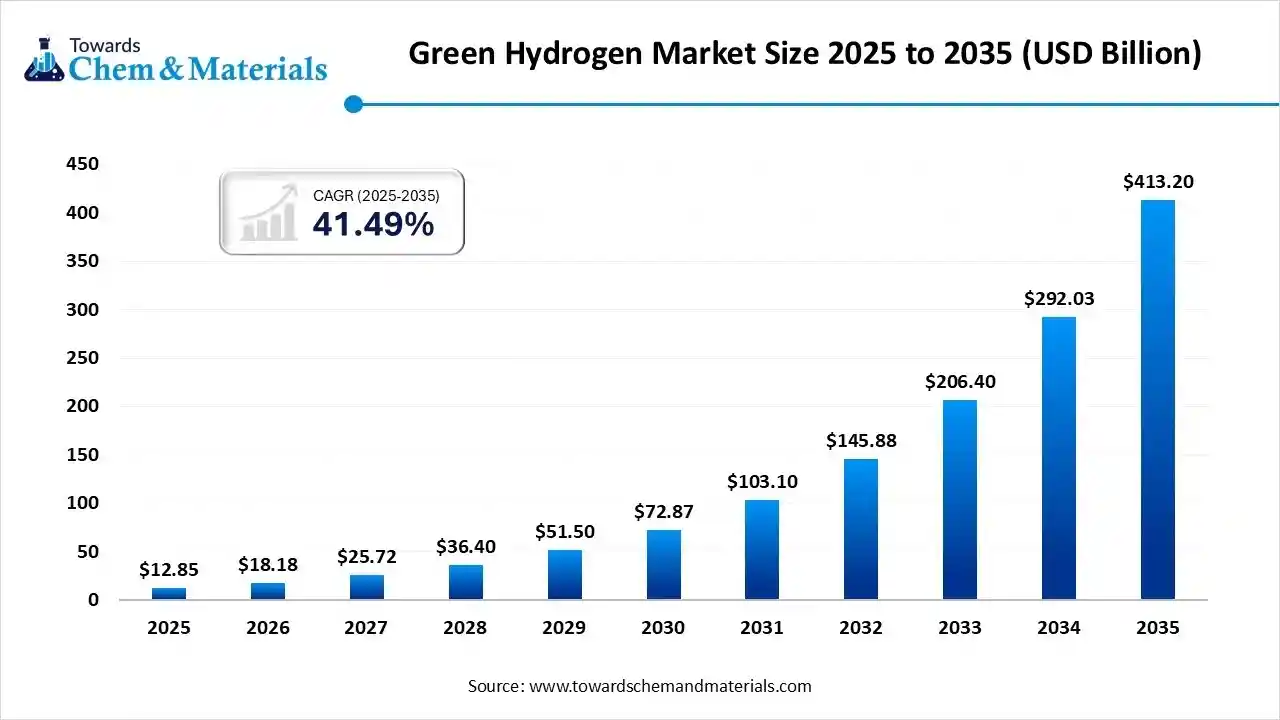

Green Hydrogen Market Size to Worth USD 413.20 Bn by 2035

According to Towards Chemical and Materials Consulting, the global green hydrogen market is projected to grow from USD 12.85 billion in 2025 to USD 413.20 billion by 2035, growing at a compound annual growth rate (CAGR) of 41.49% over the forecast period from 2026 to 2035.

Ottawa, Nov. 26, 2025 (GLOBE NEWSWIRE) -- The global green hydrogen market size reached at USD 12.85 billion in 2025 and is expected to be worth around USD 413.20 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 41.49% over the forecast period 2026 to 2035. Europe dominated the green hydrogen market with a market share of 41.51% the global market in 2025. Growing demand for clean energy alternatives, driven by global decarbonization goals, is a major factor propelling the growth of the green hydrogen market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The market is experiencing rapid growth, driven by global efforts to reduce carbon emissions and advancements in electrolysis and renewables. Government support through policies and investments is also boosting growth. Its versatility and scalability make green hydrogen a key player in the transition to sustainable energy. The market is even being propelled by its increasing use in fuel cell electric vehicles (FCEVs) and high-energy-intensive industries like steel and ammonia production, further driving demand and market expansion.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.towardschemandmaterials.com/download-sample/6038

What is Green Hydrogen?

The green hydrogen market is expanding rapidly as countries worldwide adopt ambitious decarbonization strategies and invest in renewable energy infrastructure. Produced through electrolysis powered by wind, solar, or hydro sources, green hydrogen is emerging as a key solution for reducing emissions in hard-to-abate sectors such as steel, chemicals, and heavy transport. Growing government support through subsidies, tax incentives, and national hydrogen roadmaps is further accelerating project development and commercialization.

Technological advancements in electrolyzers are lowering production costs and improving efficiency, making large-scale adoption increasingly feasible. Additionally, the market is benefiting from rising demand for long-duration energy storage and the integration of hydrogen into power grids.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Green Hydrogen Market Report Highlights

- Europe dominated the global green hydrogen market with the largest revenue share of 41.51% in 2025.

- By technology type, the alkaline electrolyzer segment accounted for the largest revenue share of 66.46% in 2025.

- By application type, the transport segment dominated with the largest revenue share of 44.39% in 2025.

- By distribution channel, the pipeline segment dominated with the largest revenue share of 61.66% in 2025.

- By sealants product, the silicone segment led the market and accounted for 35.19% of the global revenue share in 2025.

- By sealants application, the construction segment accounted for the largest revenue share of 46.7% in 2025.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6038

Green Hydrogen: An Alternative That Reduces Emissions And Cares For Our Planet

The decarbonisation of the planet is among the objectives that countries around the world have set for 2050. The production of green hydrogen, a technology based on the transformation of this element through electrolysis, is one of the keys. The IEA estimates that it would make it possible to save the 830 million tonnes of CO2 per year that originate when this gas is produced using fossil fuels.

Our way of life needs an increasing amount of watts to function. The war in Ukraine has caused a global energy crisis due to the lack of fossil fuels. This has led to an unprecedented rise in the price of natural gas and coal, causing Europe to import much more liquefied natural gas than usual, with the attendant problem of worsening climate change. However, decarbonising the planet suggests a different world in 2050: one that is more accessible, efficient and sustainable, and driven by clean energies such as green hydrogen.

Advantages And Disadvantages Of Green Hydrogen Market

This energy source has pros and cons that we must be aware of. Let's go over some of its most important good points:

- 100 % sustainable: green hydrogen does not emit polluting gases either during combustion or during production.

- Storable: hydrogen is easy to store, which allows it to be used subsequently for other purposes and at times other than immediately after its production.

- Versatile: green hydrogen can be transformed into electricity or synthetic gas and used for commercial, industrial or mobility purposes.

However, green hydrogen also has negative aspects that should be borne in mind:

- High cost: energy from renewable sources, which are key to generating green hydrogen through electrolysis, is more expensive to generate, which in turn makes hydrogen more expensive to obtain.

- High energy consumption: the production of hydrogen in general and green hydrogen in particular requires more energy than other fuels.

- Safety issues: hydrogen is a highly volatile and flammable element and extensive safety measures are therefore required to prevent leakage and explosions.

Impact of green hydrogen

Hydrogen as a fuel is a reality in countries like the United States, Russia, China, France and Germany. Others like Japan are going even further and aspire to become a hydrogen economy. Below we explain what the impact will be in the future:

Electricity and drinking water generator : These two elements are obtained by reacting hydrogen and oxygen together in a fuel cell. This process has proved very useful on space missions, for example, by providing crews with water and electricity in a sustainable manner.

Energy storage : Compressed hydrogen tanks are capable of storing energy for long periods of time and are also easier to handle than lithium-ion batteries because they are lighter.

Transport and mobility : Hydrogen's great versatility allows it to be used in those consumption niches that are very difficult to decarbonise, such as heavy transport, aviation and maritime transport. There are already several projects under way in this area, such as Hycarus and Cryoplane, which are promoted by the European Union (EU) and aim to introduce it in passenger aircraft.

Report Objectives

- To define, describe, and forecast the market size of green hydrogen, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on technology, renewable source and end-use industry

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as investment & expansion, new product development, and partnership in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6038

Green Hydrogen Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 11.86 billion |

| Revenue forecast in 2035 | USD 413.20 billion |

| Growth rate | CAGR of 38.5% from 2026 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2018 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Volume in Kilotons, Revenue in USD million, and CAGR from 2026 to 2035 |

| Segments covered | By Technology, By Application, By Distribution Channel, By Source, and By End User By Region |

| Region scope | North America; Europe; Asia Pacific; CSA; MEA |

| Country scope | U.S.; Canada; UK; Germany; France; Australia; Japan; China; India; Brazil |

| Key companies profiled | Linde .; Air Products Inc.; Air Liquide ; Cummins .; Engie ; Nel ASA; Siemens Energy; Toshiba Energy Systems & Solutions Corporation; Uniper SE; Bloom Energy |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Market Dynamics

Drivers

- Low variable electricity costs

- Technological advancements

- Global plans for net-zero emissions by 2050

- High demand from FCEVs and power industry

Restraints

- High cost of green hydrogen

- Lack of transportation infrastructure

- Energy loss in every stage of value chain

- Sustainability management

Opportunities

- Decreasing cost of electrolyzers

- Increasing government investments

- Announcement of large-capacity green hydrogen projects

- Favorable policies for green hydrogen

Challenges

- High initial investments

- Under-developed market

Green Hydrogen's Industrial Decarbonization

One major opportunity in the green hydrogen market lies in its rapid adoption across hard-to-abate industries such as steel, chemicals, and refining. These sectors are under mounting pressure to cut emissions, and green hydrogen offers a scalable pathway to replace fossil-fuel-based feedstocks. Growing corporate net-zero commitments and tightening global climate regulations are accelerating industrial pilot projects and long-term offtake agreements. As electrolyzer prices decline and renewable energy capacity expands, the economics of green hydrogen become increasingly competitive.

How AI is Transforming the Green Hydrogen Industry?

AI is transforming the green hydrogen industry by optimizing electrolyzer performance through advanced real-time data analytics, predictive control systems, and automated calibration that significantly increase energy efficiency. It strengthens operational reliability by forecasting renewable energy generation, such as solar and wind, allowing production plants to intelligently balance loads, reduce downtime, and operate at lower costs. AI-driven materials discovery accelerates innovation by simulating thousands of catalyst and membrane configurations, shortening R&D cycles and enabling breakthroughs that improve hydrogen yield and reduce degradation.

Government Initiatives for the Green Hydrogen Industry:

- National Green Hydrogen Mission (NGHM): Launched in January 2023, this mission provides the overarching strategic framework and budget to establish India as a global hub for the production, use, and export of green hydrogen.

- Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme: This program, a major component of the NGHM, offers financial incentives (Production Linked Incentives or PLI) for the domestic manufacturing of electrolysers and the production of green hydrogen to reduce costs.

- Green Hydrogen Policy (2022): This policy provides an enabling regulatory framework, including a waiver of inter-state transmission system (ISTS) charges for 25 years and expedited open access to the grid, to facilitate the sourcing of renewable energy for green hydrogen production.

- Pilot Projects: The government is funding pilot projects in hard-to-abate sectors like steel, shipping, and mobility to demonstrate the commercial viability and application of green hydrogen technologies.

- Development of Green Hydrogen Hubs: The Mission supports identifying and developing specific regions as "Green Hydrogen Hubs" by developing the necessary infrastructure, such as storage bunkers near ports, to support large-scale production and export capabilities.

What are the Key Trends of the Green Hydrogen Market?

- Technological Advancements and Cost Reduction: Innovations in electrolyzer technology, particularly in Proton Exchange Membrane (PEM) and Solid Oxide Electrolyzers (SOEC), are continuously improving efficiency and lowering production costs. Driven by economies of scale and R&D efforts, the cost of green hydrogen is projected to become competitive with fossil fuel-based alternatives in the coming years.

- Strong Government Support and Policy Initiatives: Governments worldwide are implementing national hydrogen strategies, subsidies, and financial incentives (like the US Infrastructure Investment and Jobs Act or India's National Green Hydrogen Mission) to accelerate market development and de-risk investments. These policies are crucial for fostering a stable market and encouraging private sector participation in building the necessary infrastructure.

- Diversification of End-Use Applications: Beyond traditional industrial uses (like in refineries and chemical production), green hydrogen is increasingly adopted in new sectors such as heavy-duty transportation (trucks, ships, aviation) and power generation (grid stabilization and energy storage). This expansion into hard-to-decarbonize sectors is a key driver for market growth and essential for achieving global net-zero emissions targets.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6038

Green Hydrogen Market Segmentation Insights

Technology Insights

Which Technology Segment Leads the Green Hydrogen Market?

In 2025, the alkaline electrolyzer segment led the market because it offered the most cost-effective and technologically mature solution for large-scale hydrogen production. Its longer operational lifespan and ability to run continuously made it highly attractive for industrial users and utility-scale projects. Manufacturers also benefited from well-established supply chains, which kept production costs lower compared to newer technologies like PEM electrolyzers. In 2025, expanding renewable energy installations created strong demand for el

The polymer electrolyte membrane (pem) electrolyzer is expected to grow fastest in the forecast period because of its superior ability to operate efficiently with variable renewable energy sources like solar and wind. Its fast response time and high hydrogen purity made it especially valuable for mobility, aerospace, and high-grade industrial applications. Advances in materials science and manufacturing lowered production costs, helping PEM systems scale more competitively.

Application Insights

What Made the Transport Segment Lead the Green Hydrogen Market in 2025?

The transport segment led the market in 2025 primarily due to its ability to decarbonize sectors where batteries face limitations, such as heavy-duty trucks, buses, shipping, and aviation. Governments accelerated hydrogen mobility through subsidies, fuel-cell vehicle incentives, and national hydrogen corridor projects, boosting large-scale adoption. Fuel-cell electric vehicles (FCEVs) offered longer driving ranges and faster refueling times, making them more suitable for commercial fleets. Rapid expansion of hydrogen refueling infrastructure, supported by public-private partnerships, further strengthened market leadership.

The power generation is the second-largest segment, leading the market mainly because utilities increasingly turned to hydrogen as a long-term solution for clean, dispatchable energy. Growing concerns over grid stability and renewable intermittency pushed investment towards hydrogen-based power plants capable of storing excess solar and wind energy. Governments and energy regulators supported these projects through incentives for hydrogen-ready turbines and long-duration energy storage technologies.

Distribution Channel Insights

How Pipeline Segment Leads the Green Hydrogen Market?

In 2025, the pipeline segment led the market because it offered the most efficient and cost-effective method for transporting hydrogen over long distances. Growing investments in repurposing existing natural gas pipelines enabled faster deployment and lower infrastructure costs compared to building new transport systems. Pipelines also supported large industrial clusters and hydrogen hubs that required constant, high-volume supply. Governments and energy agencies promoted pipeline networks to strengthen regional hydrogen economies and improve cross-border energy trade.

The cargo segment is expected to grow fastest over the forecast period because hydrogen-powered fuel-cell systems proved especially suitable for heavy-duty freight operations that require long range and fast refueling. Logistics companies increasingly adopted hydrogen solutions to strict meter emissions regulations and sustainability mandates for fleet decarbonization. Hydrogen offers a clear advantage over batteries for long-haul cargo movement by minimizing downtime and supporting higher payload capacities.

Source Insights

The solar renewable energy sector dominates the green hydrogen space because it is an abundant resource in many parts of the world and is very beneficial when there is an abundance of sunlight. Countries such as India, Australia, and a few regions of Africa have established solar PV and solar thermal energy that can be used to run the electrolyzers that make hydrogen. Since hydrogen is converted from solar energy, solar also represents continuous and intermittent renewable power throughout the day hours which is an excellent way to reduce carbon emissions and associated costs. The large-scale projects being deployed in deserts around the world, components for hydrogen, also make intensive hydrogen solar power projects far more attractive in terms of the project.

Global Green Hydrogen Market, By Source, 2022-2024 (USD Million)

| By Source | 2022 | 2023 | 2024 |

| Solar | 1,394.6 | 1,953.8 | 2,739.1 |

| Wind | 2,128.7 | 2,984.4 | 4,186.9 |

| Others | 953.4 | 1,329.3 | 1,854.7 |

Wind energy plays a prominent role and is the fastest growing segment in the green hydrogen market due to the alignment of producing wind resources in windy places such as Europe and the coastal regions of water bodies. The wind turbines are also always working night and day, unlike solar. This represents a more stable hydrogen electrolyzer production. The Germany and UK governments have also advocated for wind-to-hydrogen projects to help reduce burdensome emissions developed from heavy industries.

End User Insights

The refining segment dominated the green hydrogen market with a revenue share of 41.85% in 2025. This is primarily because it is the world's largest consumer of hydrogen, using millions of tons annually for essential processes such as hydrocracking and hydrotreating to produce cleaner fuels. This massive, established demand provides an immediate, ready-made market for green hydrogen that other industrial or mobility applications currently lack. The existing infrastructure for hydrogen storage and pipelines makes integrating new, green hydrogen production facilities a more direct and feasible technical challenge than building new end-user supply chains from scratch, thereby solidifying its initial market dominance.

Global Green Hydrogen Market, By End User, 2022-2024 (USD Million)

| By End User | 2022 | 2023 | 2024 |

| Refining | 1,869.9 | 2,620.5 | 3,675.1 |

| Ammonia | 1,579.1 | 2,213.2 | 3,104.2 |

| Methanol | 658.7 | 924.3 | 1,298.0 |

| Iron & Steel | 271.4 | 381.6 | 536.7 |

| Others | 97.7 | 127.9 | 166.8 |

The ammonia segment is expected to grow at the fastest rate over the projection period because it can be chemically converted into fertilizers and is easy to store and transport. It is also a clean-burning fuel, making it useful as a shipping fuel and a low-carbon option for power plants. Since many countries already have infrastructure for ammonia use, switching to ammonia made from green hydrogen is much simpler and faster.

The iron & steel segment is expected to experience notable growth in the green hydrogen market, as this industry seeks to reduce carbon emissions. In the steel production process, hydrogen can replace steel, making it more environmentally friendly. In Europe, demand for cleaner steel to meet climate targets is driving the growth of new green hydrogen-based steel plants.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

North America Green Hydrogen Market Trends

The North American green hydrogen market is being driven by a confluence of factors that emphasize sustainability and innovation. A primary driver is the increasing commitment to achieving net-zero emissions, prompting both government and private sector investments in green hydrogen technologies. This is complemented by a growing demand for fuel cell electric vehicles (FCEVs) and the need for cleaner energy sources across various industries, including transportation and power generation.

U.S. Green Hydrogen Market Trends

The U.S. green hydrogen market is being propelled by several key drivers that emphasize sustainability and innovation. A significant factor is the rising commitment to achieving net-zero emissions, which has led to increased government support and investment in renewable energy projects, particularly in hydrogen production. The growing demand for fuel cell electric vehicles (FCEVs) further stimulates the market, as green hydrogen serves as a clean fuel alternative that aligns with environmental goals.

Europe's Green Hydrogen Vanguard: Leading the Global Green Hydrogen Industry

Europe green hydrogen market accounted for a significant revenue share of about 41.51% in 2025 due to its aggressive climate policies and binding net-zero targets that accelerated large-scale hydrogen deployment. The EU's multi-billion-euro funding programs, including the Hydrogen Strategy and Important Projects of Common European Interest (IPCEI), boosted infrastructure, electrolyzer manufacturing, and cross-border hydrogen networks. Countries like Germany, Spain, and the Netherlands led with massive renewable energy capacity, making Europe a global hub for green hydrogen production. Strong industrial participation from steel, chemicals, and mobility sectors further strengthened demand across the region.

Germany Green Hydrogen Market Trends

Germany's market in 2025 grew rapidly due to strong government initiatives under the National Hydrogen Strategy aimed at scaling domestic production. The country expanded electrolyzer manufacturing capacity and invested heavily in renewable energy projects to support large-volume hydrogen generation. Industrial sectors such as steel, chemicals, and heavy transport are increasingly adopting green hydrogen to meet strict emissions reduction targets.

Asia Pacific: The Epicenter of Green Hydrogen’s Rapid Rise

The Asia Pacific green hydrogen market size was valued at USD 6.21 billion in 2025 and is expected to reach USD 199.91 billion by 2035, growing at a CAGR of 41.51% from 2026 to 2035.

Asia Pacific recorded the fastest growth in the market in 2025 as countries rapidly expanded renewable energy capacity to support large-scale hydrogen production. Nations like China, Japan, South Korea, and Australia launched ambitious hydrogen roadmaps, accelerating investments in electrolyzer manufacturing and export-oriented hydrogen projects. Strong government support, including subsidies, pilot zones, and long-term procurement commitments, boosted market momentum across the region.

China Green Hydrogen Market Trends

The growth of the green hydrogen market in China is driven by several key factors that align with the country's ambitious energy and environmental goals. A primary driver is the strong governmental commitment to decarbonization, supported by policies aimed at reducing carbon emissions and promoting renewable energy sources. China's abundant low-cost renewable electricity, particularly from solar and wind, facilitates the economically viable production of green hydrogen, making it competitive with traditional hydrogen sources.

Japan Green Hydrogen Market Trends

Japan's market in 2025 was driven by strong government backing through the national Hydrogen Strategy aimed at achieving carbon neutrality by 2050. The country accelerated investments in large-scale electrolyzer projects and hydrogen import terminals to secure a stable, long-term clean energy supply. Japan advanced fuel-cell technologies for both mobility and stationary power, reinforcing its leadership in hydrogen innovation.

UK Green Hydrogen Market Trends

The UK green hydrogen market is driven by several key factors that emphasize sustainability and energy independence. A primary motivator is the government's commitment to achieving net-zero carbon emissions by 2050, which has led to the establishment of a comprehensive Hydrogen Strategy aimed at scaling up production and infrastructure. This includes significant investments in electrolytic hydrogen production and carbon capture utilization and storage (CCUS) technologies, supported by funding initiatives that encourage private investment in hydrogen projects.

Central & South America Green Hydrogen Market Trends

The Central and South America green hydrogen market is characterized by its abundant renewable energy resources, particularly solar and wind, which position the region as a potential leader in clean hydrogen production. Countries like Chile, Brazil, and Colombia are at the forefront, implementing national strategies to harness this potential and aiming for significant production targets in the coming years. The region has over 140 green hydrogen projects in various stages of development, reflecting a growing political will and investment interest.

Middle East & Africa Green Hydrogen Market Trends

The Middle East and Africa (MEA) green hydrogen market is characterized by its abundant renewable energy resources, particularly solar and wind, which provide a strong foundation for sustainable hydrogen production. Countries in the region are increasingly recognizing the potential of green hydrogen as a key solution for decarbonization and energy transition, leading to substantial government support and strategic investments in infrastructure. The MEA region is at a pivotal juncture, with numerous large-scale projects underway, such as those in Saudi Arabia and Oman, aimed at harnessing these renewable resources for green hydrogen production.

Top Companies in the Green Hydrogen Market & Their Offerings:

- Engie : Engie is present across the entire hydrogen value chain, focusing on developing industrial-scale green hydrogen projects, from renewable electricity production to the development of end-uses in industry, mobility, and energy storage.

- Linde .: Linde is a global leader covering the entire hydrogen value chain, providing end-to-end solutions from production technologies (including large-scale electrolyzers through a joint venture with ITM Power) to storage, distribution via pipelines, and fueling stations.

- Nel ASA: Nel is a dedicated hydrogen company that manufactures and supplies both alkaline and PEM electrolyzer technology and hydrogen fueling station equipment to produce, store, and distribute green hydrogen from renewable energy sources.

- Siemens Energy: Siemens Energy offers a comprehensive portfolio for the hydrogen value chain, including the production of industrial-scale PEM electrolyzer systems (Silyzer) and developing solutions for using hydrogen and its derivatives in gas turbines for power generation and industrial applications.

- Toshiba Energy Systems & Solutions Corporation: Toshiba is involved in developing and supplying PEM fuel cell stacks and electrolysis systems, with a focus on applying its hydrogen technology expertise to integrated energy systems and mobility solutions.

- Uniper SE: Uniper is a utility and energy company focused on large-scale green hydrogen projects, particularly in converting existing power plants and developing import terminals to secure a supply of green hydrogen for industrial decarbonization in Europe.

More Insights in Towards Chemical and Materials:

- Biohydrogen Market : The global biohydrogen market size is calculated at USD 76.78 million in 2025 and is predicted to increase from USD 82.51 million in 2026 and is projected to reach around USD 157.80 million by 2035, The market is expanding at a CAGR of 7.47% between 2025 and 2035.

- Europe Green Hydrogen Market : The Europe green hydrogen market size is calculated at USD 6.83 billion in 2025 and is anticipated to reach around USD 147.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 40.74% over the forecast period from 2025 to 2034.

- U.S. Green Hydrogen Market : The U.S. green hydrogen market size is calculated at USD 379.07 million in 2025 and is anticipated to reach around USD 6993.64 million by 2034, growing at a compound annual growth rate (CAGR) of 38.25% over the forecast period from 2025 to 2034.

- Hydrogenated Vegetable Oil Market : The global hydrogenated vegetable oil market size accounted for USD 35.25 billion in 2024 and is predicted to increase from USD 37.84 billion in 2025 to approximately USD 71.64 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034.

- Hydrogen Peroxide Market : The global hydrogen peroxide market size was valued at USD 1475.43 billion in 2024 and is estimated to hit around USD 2718.01 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.30% during the forecast period 2025 to 2034.

- Green Polypropylene Market : The global green polypropylene market size is calculated at USD 25.65 billion in 2025 and is expected to be worth around USD 72.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.27% over the forecast period 2025 to 2034.

- Green Chemicals Market : The global green chemicals market size was estimated at USD 14.94 billion in 2025 and is predicted to increase from USD 16.11 billion in 2026 to approximately USD 29.49 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034.

- Green Ammonia Market : The global green ammonia market is experiencing rapid growth, with volumes expected to increase from 1.55 million tons in 2025 to 348.18 million tons by 2034, representing a robust CAGR of 82.49% over the forecast period.

- Green Coatings Market : The global green coatings market size is calculated at USD 145.19 billion in 2025 and is predicted to increase from USD 152.43 billion in 2026 and is projected to reach around USD 236.27 billion by 2035, The market is expanding at a CAGR of 4.99% between 2025 and 2035.

- Green Methanol Market : The global green methanol market size accounted for USD 2.66 billion in 2024, grew to USD 3.22 billion in 2025, and is expected to be worth around USD 17.84 billion by 2034, poised to grow at a CAGR of 20.96% between 2025 and 2034.

Green Hydrogen Market Top Key Companies:

- Air Liquide

- Air Products Inc.

- Bloom Energy

- Cummins .

- Engie

- Linde .

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Recent Developments

- In November 2025, Exxon Mobil stopped its plan to build the world’s largest hydrogen production facilities because of weak customer demand. The announcement was made by CEO Darren Woods on November 21, 2025.

- In April 2025, Oman’s Hydrom signed agreement worth USD 11 billion with Electricité de France ( EDF Group) to develop two green hydrogen production projects. In June 2022, Siemens Energy and Air Liquide S.A. had signed a joint venture to manufacture industrial-scale large quantities renewable hydrogen electrolyzers. This collaboration aims to facilitate the development of a sustainable hydrogen economy in Europe. The joint venture will promote the growth of a European ecosystem for hydrogen technology and electrolysis. Projected capacity of three gigatons per year by 2025.

- In September 2025, Thermax has partnered with Ceres Power to manufacture large-scale Solid Oxide Electrolysis Cells (SOEC) for green hydrogen production, focusing on utilizing industrial waste heat. This collaboration aims to create efficient systems tailored for industries such as steel and refineries. Thermax plans to establish a manufacturing facility and localize components, marking a significant advancement in India's green hydrogen sector.

- In September 2025, Jindal Steel (JSPL) and Jindal Renewables (JRPL) announced partnership. This partnership highlights both companies' strong commitment to decarbonization and leadership in green energy within India's steel sector. Under the agreement, JSPL plans to integrate green hydrogen into its Direct Reduced Iron (DRI) units at the Angul facility in Odisha, marking a substantial advancement toward low-emission steel production.

Green Hydrogen Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Green Hydrogen Market

By Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

By Application

- Power Generation

- Transport

- Others

By Distribution Channel

- Pipeline

- Cargo

By Source

- Solar Energy

- Wind Energy

- Others (hydropower, geothermal, and hybrid of solar & wind)

By End User

- Refining

- Ammonia

- Methanol

- Iron & Steel

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6038

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/