NorthWest Intersects 27.7 Metres of 1.23% Copper and 1.53g/t Gold (2.63% CuEq) at Kwanika Starting at 198 Metres

TORONTO, Nov. 06, 2025 (GLOBE NEWSWIRE) -- NorthWest Copper Corp. (“NorthWest” or the “Company”) (TSX-V: NWST) is pleased to announce excellent assay results from the third drill hole of its 2025 expanded diamond drilling program at its 100% owned Kwanika project in British Columbia. Hole K-25-271 successfully intersected multiple copper-gold zones, highlighted by a significant intercept of 27.7 metres grading 1.23 % Cu, 1.53 g/t Au (2.63% copper equivalent1, “CuEq”) within the Central Zone. Results to date, including this hole, support management’s belief that the 2023 Preliminary Economic Assessment2 (the “2023 PEA”) significantly understates the economic potential of the Kwanika project as the 2023 PEA does not reflect the positive impact of targeting higher-grade mineralization within the current mineral resource. Results to date are intersecting these higher-grade zones as expected.

Drill results thus far have met or exceeded expectations.

To highlight, drill hole K-25-271 yielded multiple positive outcomes. Primarily, the hole intersected the up-dip extension of the Central Zone shallower than expected, potentially filling a 100-metre gap in the mineralization between the Pit and Central Zones. Additionally, the hole extended the Western Zone down-dip beyond the Company’s original expectations, confirming that mineralization remains open both laterally and at depth for further expansion. Finally, the hole extended the low-grade mineralization around the Pit Zone by roughly 30 metres towards the west, indicating possible increases to open pit mineral resources.

Drill Hole Highlights:

| Pit Zone: | 48.2 metres of 0.31 % Cu, 0.11 g/t Au (0.42% CuEq) from 77.8 metres |

| Central Zone: | 28.5 metres of 0.70 % Cu, 0.60 g/t Au (1.26% CuEq) from 139.5 metres, and |

| 34.8 metres of 1.03 % Cu, 1.26 g/t Au (2.18% CuEq) from 191.1 metres, including: | |

| 2.8 metres of 0.60 % Cu, 0.49 g/t Au (1.06% CuEq) from 191.1 metres, and | |

| 27.7 metres of 1.23 % Cu, 1.53 g/t Au (2.63% CuEq) from 198.2 metres | |

| Western Zone: | 13.0 metres of 0.19 % Cu, 0.53 g/t Au (0.77% CuEq) from 507.0 metres, and |

| 22.3 metres of 0.37 % Cu, 0.35 g/t Au (0.71% CuEq) from 611.8 metres | |

The Company’s current drill program, particularly for the underground, is designed to focus efforts on defining higher-grade zones within the current mineralization that targets grades of roughly 1.5-2.5 times those grades incorporated in the capital-intensive, underground block cave mining method presented in the 2023 PEA.

Results to date form part of an expanded 6,435 metre drill program that was completed in October. Results from the remaining fifteen holes are pending and the Company anticipates releasing additional information on these holes as they become available over the coming weeks.

Paul Olmsted, CEO of NorthWest, commented: “Results from the third hole continue to build on the excellent results reported in October on the higher-grade copper-gold zones at Kwanika. The ability to deliver an exceptional intercept grading 2.63% CuEq in the Central Zone demonstrates the quality and growth potential of these zones within the mineralized system. We look forward to reporting on the remaining holes from the 2025 drill program and receiving results from our metallurgical program before the end of the year. Each of these are critical to advancing an updated mineral resource and new PEA in 2026.”

Geoff Chinn, VP Business Development and Exploration of NorthWest, added: “Hole K-25-271, continues to show support for structural controls on higher-grades. Higher-grade mineralization within the Central Zone, returned a combined true width estimate of 36.2 metres across both upper and lower mineralized intervals, including a 19.9 metre estimated true width intercept grading 2.18% CuEq. Results to date strengthen our confidence in our vision of higher-grade zones within the current mineral resource with a view to targeted grades 1.5-2.5 times the current 1.0% CuEq underground mineral resource3.”

Kwanika Exploration Program

On April 10, 2025, NorthWest announced a target model (“ Target Model”) for refining the strategy for its flagship Kwanika project. This approach was designed to better evaluate geological controls on zones targeted to grade between 1.5% to 2.5% CuEq over significant combined thicknesses. These zones are potentially more suitable for a selective top-down bulk underground mining method. Additionally, the strategy aims to expand on near-surface mineralization to support increases to open pit mineral resources and a revised mine design.

There are three higher-grade, potentially interconnected zones comprising the Target Model: Pit, Central and Western Zones. These zones host two broad mineralized intervals separated by late dykes, with the combined thicknesses of the intervals targeted at a sizable 30 to 45 metres.

In advancing the Company’s 2025 exploration program, the drilling was designed to validate, infill and expand on the Company’s understanding of the structural controls on the higher-grade copper-gold mineralization within the Target Model. For 2025, the diamond drill program was designed to intersect both the east dipping Central Zone and the north dipping Western Zone beneath it. Early results, including hole K-25-271 confirm that progress is being achieved.

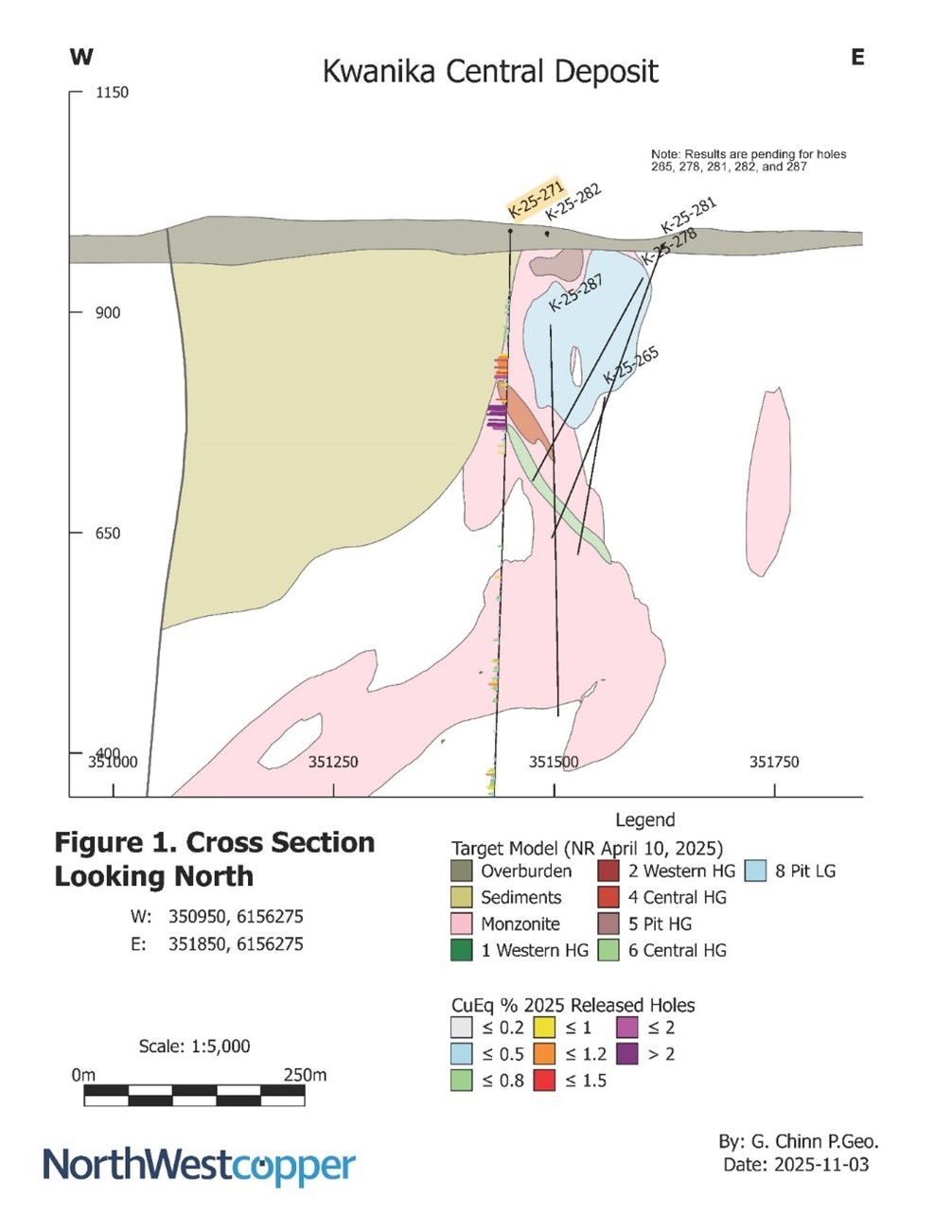

Figure 1 illustrates the position of hole K-25-271 relative to the Target Model Central and Pit Zones. The hole was drilled with HQ (63.5 mm) core, analyzed using sawn half core samples and drilled vertically (0 azimuth, -90 dip) to a total depth of 693 metres. A summary of the geological aspects of the hole is presented below.

Figure 1: Cross Section of Target Model at K-25-271 Drill Location

Collar locations and continuous mineralized intercepts are summarized in Table 1 and Table 2. Planned hole locations for the program are available in the news release dated September 2, 2025.

Drilling intersected low-grade copper-gold mineralization surrounding the Pit Zone that extends mineralization towards the west by approximately 30 metres. This intercept returns attractive grades suitable for potential inclusion in an open pit mineral resource, returning:

- 0.31% Cu, 0.11g/t Au, and 1.45 g/t Ag (0.42 % CuEq) over 48.2 metres with unknown true width starting at 77.8 metres.

The hole then intersected the upper part of the Central Zone about 50 metres higher than expected indicating that mineralization may be deflecting eastwards towards higher-grades areas in the Pit Zone. This could extend continuous higher-grade mineralization between the Central Zone and the Pit Zone, expanding higher-grade zones by about 100 metres. The upper Central Zone intersection, may indicate continuity of mineralization between the Central and Pit Zones, returning:

- 0.70% Cu, 0.60g/t Au, and 2.78 g/t Ag (1.26 % CuEq) over 28.5 metres with an estimated true thickness of 16.3 metres starting at 139.5 metres.

The hole then intersected the lower part of the Central Zone, successfully infilling an area tested previously by widely spaced, low angle holes. Drill results confirm a broad, continuous zone of higher-grade copper-gold mineralization consistent with the Company’s Target Model, returning:

- 1.03 % Cu, 1.26 g/t Au, and 3.29 g/t Ag (2.18 % CuEq) over 34.8 metres with an estimated true width of 19.9 m starting at 191.1 metres.

Well below the Central Zone, the hole intersected two mineralized intervals within the Western Zone, extending these zones down-dip and laterally. Both lenses remain open for further expansion, returning:

- 0.19 % Cu, 0.53 g/t Au, and 0.93 g/t Ag for 0.77% CuEq over 13.0 m with an estimated true width of 8.9 m starting at 507.0 m, includes dilutive late dykes, and

- 0.37 % Cu, 0.35 g/t Au, and 2.45 g/t Ag for 0.71% CuEq over 22.3 m with an estimated true width of 15.2 m starting at 611.8 m.

Table 1: Drill Results in this News Release4 5

| Hole | From | To | Length | Zone | Cu | Au | Ag | CuEq | True Width | Description |

| (m) | (m) | (m) | (%) | (g/t) | (g/t) | (%) | Est. (m) | Target Model Zone Reference | ||

| K-25-271 | 77.8 | 126.0 | 48.2 | Pit | 0.31 | 0.11 | 1.45 | 0.42 | Unknown | Lower-Grade Pit Zone 8 |

| K-25-271 | 139.5 | 168.0 | 28.5 | Central | 0.70 | 0.60 | 2.78 | 1.26 | 16.3 | Higher-Grade Gold Zone 4 |

| K-25-271 | 191.1 | 225.9 | 34.8 | Central | 1.03 | 1.26 | 3.29 | 2.18 | 19.9 | Higher-Grade Gold Zone 6 |

| Including | 191.1 | 193.9 | 2.8 | Central | 0.60 | 0.49 | 2.30 | 1.06 | 1.6 | Higher-Grade Gold Zone 6 |

| Including | 198.2 | 225.9 | 27.7 | Central | 1.23 | 1.53 | 3.87 | 2.63 | 15.9 | Higher-Grade Gold Zone 6 |

| K-25-271 | 486.2 | 490.0 | 3.8 | Western | 0.38 | 0.41 | 1.99 | 0.76 | 2.6 | Outside Target Model |

| K-25-271 | 507.0 | 520.0 | 13.0 | Western | 0.19 | 0.53 | 0.93 | 0.67 | 8.9 | Higher-Grade Gold Zone 1 |

| K-25-271 | 611.8 | 634.0 | 22.3 | Western | 0.37 | 0.35 | 2.45 | 0.71 | 15.2 | Higher-Grade Gold Zone 2 |

Table 2: Drill Collar Information6

| Hole | Collar X | Collar Y | Collar Z | Collar Azimuth | Collar Dip | Final Length | |

| K-25-271 | 351450 | 6156285 | 992 | 0 | -90 | 693 | |

Quality Assurance / Quality Control

Drilling at Kwanika in 2025 was designed and supervised by NorthWest, implemented by InData Geoscience with assay QA/QC checks by Explore Geosolutions. Samples were collected, tracked and an external QA/QC program was implemented using blanks and standards to monitor analytical accuracy and precision. The samples were sealed on site and shipped to Activation Laboratories Ltd. (“Actlabs”) in Kamloops BC. The laboratory’s internal quality control system complies with global certifications for quality ISO 17025. Drill core samples were analyzed using a combination of Actlabs multi-element 1F2 analysis for low level concentrations (4-Acid Digestion, ICP-OES) and the 8-4 Acid ICP-OES analysis for higher level concentrations (4-Acid Digestion, ICP-OES with automatic over limits for base metals and silver). Gold, platinum and palladium assaying was completed with 1C-OES method, using a 30-gram fire assay with ICP finish analysis. In addition, about 5% of the sample pulps are re-assayed at a secondary laboratory to confirm reproducibility and check for bias.

Copper Equivalent

Copper Equivalent or CuEq, is a non-standard metric that is being used by the Company to provide investors with additional information to gain an improved understanding of the potential at Kwanika given the significant contribution of gold to the project. The CuEq calculation, as presented may not be comparable to similar measures presented by other companies. The Company is conducting a metallurgical program at Kwanika to determine recoveries of the higher-grade zones and therefore, as an alternative, considered the New Afton mine as a comparable deposit and applied reductions to the average realized recoveries consistent with New Afton for the Kwanika recoveries in the calculation of CuEq7. This is consistent with the metallurgical recoveries and calculation of CuEq used in the Company’s press release dated October 15, 2025.

Share Issuance

On September 18, 2025, the Company announced it entered into an amendment dated July 31, 2025, to acquire 100% of the Asitka claims and agreed to pay $87,500 through the issuance of Common Shares for part of the third anniversary payment. The Company completed the Asitka payment by issuing 245,648 Common Shares at a price of $0.3562. In addition, the Company extinguished $54,660 of debt owed to two arm’s length service providers in consideration for the issuance of 188,483 Common Shares at a price of $0.29 per share. All securities issued pursuant to the Asitka claim payment and the debt settlement are subject to a statutory hold period expiring on March 5, 2026.

Technical aspects of this news release have been reviewed, verified, and approved by Geoff Chinn, P.Geo., VP Business Development and Exploration for NorthWest, who is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Minerals Projects.

About NorthWest:

NorthWest is a copper-gold exploration and development company with a pipeline of advanced and early-stage projects in British Columbia, including Kwanika-Stardust, Lorraine-Top Cat and East Niv. With a robust portfolio in a tier one jurisdiction, NorthWest is well positioned to participate fully in strengthening global copper and gold markets. We are committed to responsible mineral exploration which involves working collaboratively with First Nations to ensure future development incorporates stewardship best practices and traditional land use. Additional information can be found on the Company’s website at www.northwestcopper.ca.

On Behalf of NorthWest

“Paul Olmsted”

CEO, NorthWest Copper

For further information, please contact:

416-457-3333

info@northwestcopper.ca

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to statements with respect to; plans and intentions of the Company; proposed exploration and development of NorthWest’s exploration property interests; the Company’s ability to finance future operations; mine plans; magnitude or quality of mineral deposits; the development, operational and economic results of current and future potential economic studies; adding the Lorraine resource to the Kwanika-Stardust Project; the Company’s goals for 2025; geological interpretations; the estimation of Mineral Resources; anticipated advancement of mineral properties or programs; future exploration prospects; the completion and timing of technical reports; future growth potential of NorthWest; and future development plans

All statements, other than statements of historical fact, included herein, constitutes forward-looking information. Although NorthWest believes that the expectations reflected in such forward-looking information and/or information are reasonable, undue reliance should not be placed on forward-looking information since NorthWest can give no assurance that such expectations will prove to be correct. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information, including the risks, uncertainties and other factors identified in NorthWest’s periodic filings with Canadian securities regulators. Forward-looking information are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking information. Important factors that could cause actual results to differ materially from NorthWest’s expectations include risks associated with the business of NorthWest; risks related to reliance on technical information provided by NorthWest; risks related to exploration and potential development of the Company’s mineral properties; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and First Nation groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in NorthWest’s filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.com).

Forward-looking information is based on estimates and opinions of management at the date the information is made. NorthWest does not undertake any obligation to update forward-looking information except as required by applicable securities laws. Investors should not place undue reliance on forward-looking information.

________________

1 CuEq assumes consensus metal prices of $2646/oz gold, $4.34/lbs copper, $29.73/oz silver calculated as follows [Cu+100*((Au/31.1035*Au Price*80%)/(Cu Price*2204.62*80%)+(Ag/31.1035*Ag Price*80%)/(Cu Price*2204.62*80%))]. See section entitled Copper Equivalent for further details.

2 NI 43-101 technical report titled “Kwanika-Stardust Project NI 43-101 Technical Report on Preliminary Economic Assessment” dated February 17, 2023, with an effective date of January 4, 2023, filed under the Company’s SEDAR+ profile at www.sedarplus.com.

3 2023 PEA, page 190-192

4 Estimated true widths based on collar azimuth and dip and the average dip of the mineralized zone

5 CuEq assumes consensus metal prices of $2646/oz gold, $4.34/lbs copper, $29.73/oz silver calculated as follows [Cu+100*((Au/31.1035*Au Price*80%)/(Cu Price*2204.62*.80%)+(Ag/31.1035*Ag Price*80%)/(Cu Price*2204.62*80%))]. See section entitled Copper Equivalent in this press release for further details.

6 Collar coordinates reference UTM Zone 10N NAD83. The collar coordinates for hole K-25-269 were corrected from the press release dated Oct. 6, 2025 and the correct collar coordinates has been included in this press release.

7 Metallurgical recoveries used by the company were 80% for each of copper, gold and silver, with copper and gold recoveries being at a significant discount to average recoveries realized at the New Afton mine, a comparable deposit to Kwanika.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/89525b6d-b4fa-4712-ba50-d5866202e140