Packaging Machinery Market Size, Segments, Share and Companies (2025-34)

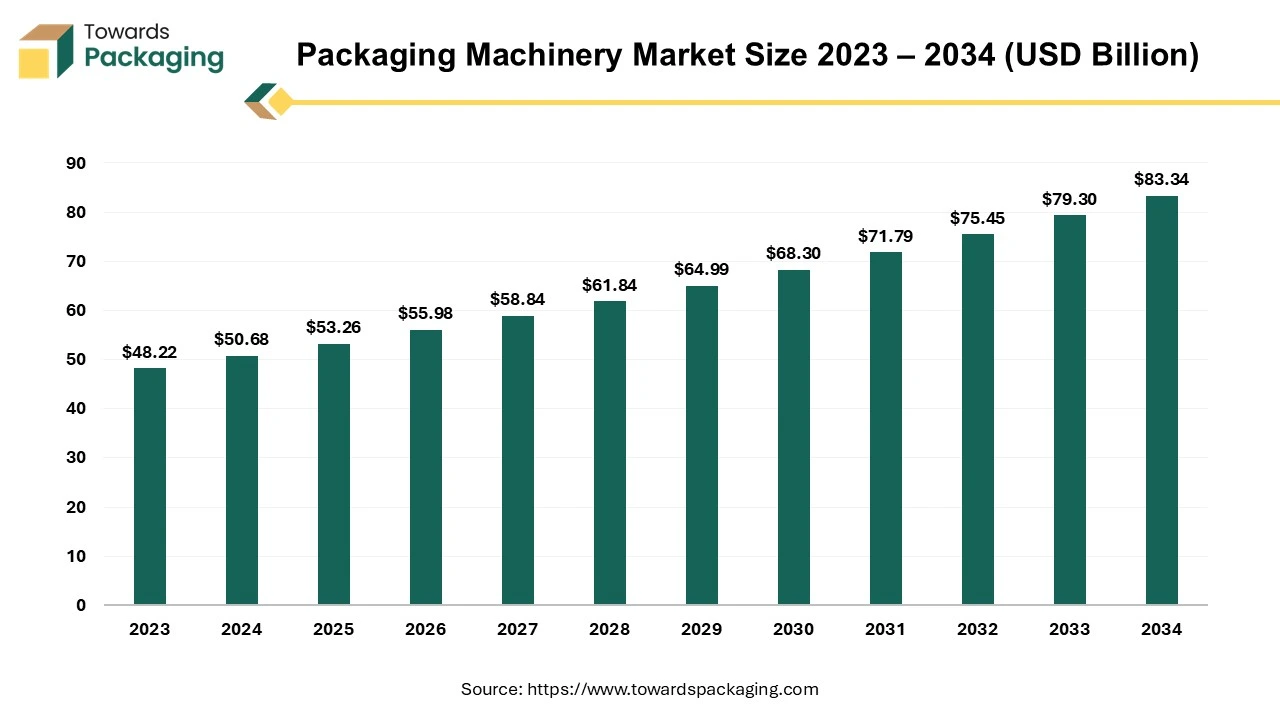

According to projections from Towards Packaging, the global packaging machinery market is set to increase from USD 55.98 billion in 2026 to nearly USD 83.34 billion by 2034, reflecting a CAGR of 5.1% during 2025 to 2034.

Ottawa, Oct. 30, 2025 (GLOBE NEWSWIRE) -- The global packaging machinery market, valued at USD 53.26 billion in 2025, is expected to rise to approximately USD 83.34 billion in 2034, based on a report published by Towards Packaging, a sister firm of Precedence Research. The packaging machinery market is essential because it drives safety, efficiency, and branding for businesses across many industries by automating and standardizing the packaging process.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Packaging Machinery?

Packaging machinery refers to automated equipment that performs tasks such as filling, sealing, labeling, wrapping, and coding to prepare goods for distribution. These machines automate the packaging process to raise efficiency, ensure consistency, and even protect products in numerous containers like bags, bottles, and boxes.

It is driven by the rising need for convenience and packaged goods, driven by urbanization and e-commerce. Other major drivers involve the push for automation and also efficiency, the increasing user and regulatory need for sustainable and eco-friendly packaging, and also technological advancements such as smart and integrated machinery.

Major Government Initiatives in the Packaging Machinery Industry:

- Production-Linked Incentive (PLI) Schemes: These schemes provide financial incentives to domestic manufacturers based on their increased production and sales. While often not specific to packaging machinery, these schemes drive investment and growth in the manufacturing sectors that use this equipment, creating a ripple effect.

- Make in India Initiative: Aims to transform India into a global manufacturing hub by promoting domestic production and attracting foreign investment across multiple sectors. For the packaging machinery industry, this means an improved business environment, streamlined regulations, and greater opportunities for technology transfer and innovation.

- Sustainable packaging regulations (e.g., Plastic Waste Management Rules): Governments set regulations like Extended Producer Responsibility (EPR), which holds manufacturers accountable for collecting and recycling their plastic packaging waste. This compels the packaging machinery sector to innovate and develop equipment compatible with eco-friendly and recyclable materials to help brands comply.

- Skill Development Initiatives (e.g., Skill India Mission): Programs like the Skill India Mission are designed to create a skilled workforce to meet the evolving demands of various industries, including manufacturing. This initiative supports the packaging machinery industry by ensuring a supply of trained technicians and engineers capable of operating and maintaining advanced and automated machinery.

- Infrastructure and Logistics Development (e.g., PM Gati Shakti): Schemes focused on upgrading national infrastructure and logistics, such as the PM Gati Shakti National Master Plan, help reduce transport costs and improve supply chain efficiency for manufacturers. For the packaging machinery industry, this creates a more robust and predictable environment for both raw material procurement and product distribution.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5115

What are the Latest Trends in the Packaging Machinery Market?

- Widespread Adoption of Automation and Smart Technologies: It is driven by the need for increased efficiency, improved quality, labor cost reduction, and enhanced sustainability. Even automation boosts production speed along with output by streamlining repetitive tasks such as filling, sealing, and sorting. This permits companies to keep up with rising consumer need for faster deliveries, mainly in the booming e-commerce sector. Moreover, it supports sustainability goals by optimizing material usage and reducing waste. Automated systems can also efficiently manage new, eco-friendly materials such as biodegradable films, which usually require high precision to process correctly.

- Increased Flexibility and Customization: It is driven by the expansion of e-commerce, evolving consumer needs for personalization and convenience, and the requirement for greater sustainability and efficiency. The need for eco-friendly packaging is driving for machinery that can manage new sustainable materials and decrease waste via efficiency and optimized material usage. Flexible machines decrease the need for multiple dedicated machines, decreasing capital investment and even maintenance expenses. Their quick changeover times raise equipment utilization, contributing to higher throughput and even lower per-unit production costs.

- Automation and efficiency: This trend is driven by the demand for higher output, reduced labor costs, and greater production accuracy. Automation incorporates robotics and advanced control systems that optimize the speed and precision of packaging lines while also minimizing human error and downtime.

- Sustainable packaging solutions: This focus is on developing machinery that can effectively handle environmentally friendly materials, such as biodegradable, recyclable, and compostable options. This addresses mounting consumer demand and global regulations aimed at reducing plastic waste.

Market Opportunity

Exponential Growth of E-Commerce

This is driven by the rising sheer volume, diversity, and even complexity of packaging needs. This expansion has forced firms to invest heavily in automated, flexible, along sustainable machinery to manage demand, reduce expenses, and stay competitive. Automated machinery is important for handling high volumes of parcels, along with ensuring quick turnaround times. Furthermore, automated systems for packing, sealing, along labeling can function the work of 12 to 20 manual packaging stations.

Unlike goods on a store shelf, even e-commerce products majorly survive a complex supply chain including multiple sorting and transit points. This need packaging that is more durable and also offers superior product protection. This drives the requirement for automated systems that can securely seal and reinforce packages.

Limitations & Challenges

High Initial Investments

Key limitations and challenges in the market involve high capital investment for developed machinery, a shortage of skilled labor, the complexity of designing versatile equipment, and pressure from evolving environmental along safety regulations. Other challenges include cost control, mainly due to fluctuating raw material expenses, and managing production efficiency while meeting requirements for customization and sustainability.

More Insights of Towards Packaging:

- Labeling Machine Market Driven by 3.84% CAGR (2025-34)

- Cosmetic Packaging Machinery Market Key Business Drivers & Industry Forecast

- Paper Machinery Market Size, Segments and Regional Insights (NA, EU, APAC, LA, MEA)

- Vacuum Sealing Machine Market Strategic Review, Key Business Drivers & Industry Forecast

- Ampule Sticker Labelling Machine Market Size, Demand, and Trends Analysis 2034

- Cartoning Machines Market Drives at 5.05% CAGR (2025-34)

- HFFS Pouching Machines Market Research, Consumer Behavior, Demand and Forecast

- Wrap-Around Cartoning Machines Market Research Insight: Industry Insights, Trends and Forecast

- Premix Packaging Machine Market Dynamics, Competitive Forces & Strategic Pathways

- Pharma Blister Packaging Machines Market Drives at 2.85% CAGR

- PET Bottle Blow Molding Machine Market 2025 Insights: Injection Blow Segment Leads, Asia Pacific to Grow Fastest by 2034

- Sachet Packaging Machines Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Vertical Form-Fill-Seal (VFFS) Machines Market Strategic Growth, Innovation & Investment Trends

- Vial Cap Sealing Machine Market Amid Surge in Injectable Drug Production

- Beverage Packaging Machine Market: Direct Sales Outperform as Market Expands Globally

Regional Analysis

Who is the Leader in the Packaging Machinery Market?

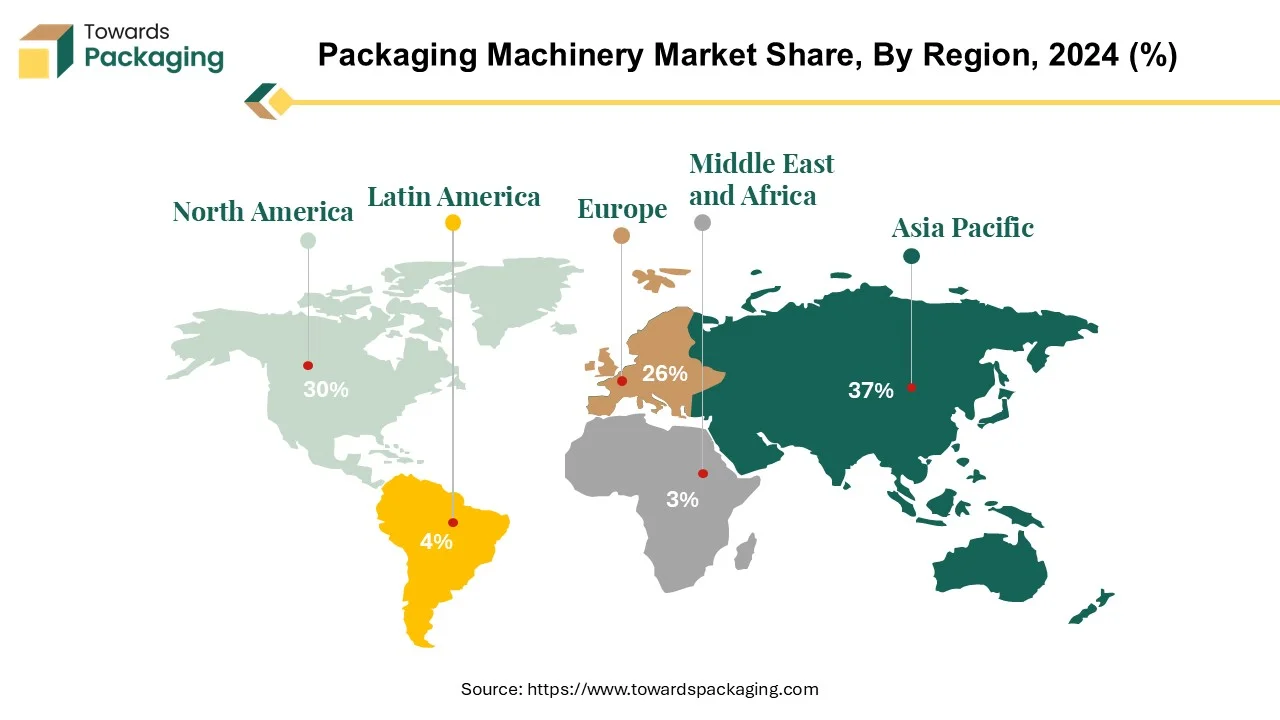

Asia Pacific leads the market because of its strong production base, rapid industrialization, and even booming user demand in sectors such as food and beverage, pharmaceuticals, along e-commerce. Thus, rapid urbanization and even a rising middle class have fueled the need for packaged goods, which includes convenience foods, beverages, and also pharmaceuticals. Firms are investing in advanced technologies such as automation, AI, and smart packaging to enhance efficiency and accuracy, and also to meet evolving consumer needs. The expanding pharmaceutical and even biopharmaceutical sectors in the region, and increased R&D, are driving the requirement for high-speed and automated packaging equipment.

China Market Trends

China's market trends significantly influence the market because China is a worldwide leader in producing as well as consuming packaging machinery, boosted by its massive e-commerce, food and beverage, and even pharmaceutical sectors. Consumer need for customized and sustainable packaging, combined with government policies encouraging automation and technological advancement, boosts both the domestic need for and export of packaging machinery, which affects global expenses, production, and innovation.

Japan Market Trends

Japan's market trends impact the market as Japan is a major innovator, along with its trends being driven by a strong focus on automation, sustainability, along adapting to demographic shifts such as an aging population, as well as smaller households. These factors contribute to the global need for eco-friendly packaging, advanced machinery for e-commerce, and even convenience products, impacting what machinery other markets will manufacture and adopt.

How is the Opportunistic Rise of North America in the Packaging Machinery Market?

The North American market is experiencing an opportunistic rise driven by various key factors, including the move for automation along with smart technology, the expansion of e-commerce, and rising need for sustainability. Changes in consumer lifestyles, like the choices for convenience and even ready-to-eat foods, are propelling the need for automated as well as high-speed packaging machinery. Meanwhile, the food and beverage sector remains the biggest end-user segment for packaging machinery.

U.S. Market Trends

The U.S. market is undergoing growth driven by automation, mainly in the food and beverage, pharmaceutical, along cosmetics sectors. Key trends involve a strong need for smart and sustainable packaging solutions, the rising usage of advanced technologies such as robotics and pneumatic systems, and an aim to develop compact and even efficient machinery for e-commerce and changing user habits.

Canada Market Trends

The Canadian market is driven by e-commerce along with food processing sectors, and even a shift towards sustainable as well as eco-friendly packaging solutions. Key trends involve the increasing need for automation and efficiency, so as the fastest-growing segment being Form-Fill-Seal (FFS) machinery, along with a rising focus on sustainable and even energy-efficient equipment to meet regulations, along consumer preferences.

Segment Outlook

Machinery Insights

Which Machinery Segment Dominates the Packaging Machinery Market?

The filling machine segment dominates the market in 2024, due to its vital and universal role in packaging, funded by the massive global need for packaged products. The rising demand for automation to efficiently and even accurately fill a vast range of products into numerous containers, coupled with technological advancements in precision and speed, boosts the supremacy of this segment over multiple industries, including pharmaceuticals, food and beverage, and cosmetics. The growth in consumption of packaged goods, pushed by consumer choices for convenience, health, along longer shelf life, directly fuels the demand for high-capacity filling systems.

End User Insights

Which End-user Dominates the Packaging Machinery Market?

The food and beverage segment dominates the market in 2024, due to the massive and continuous requirement for packaged goods driven by changing urbanization, lifestyles, and growing disposable incomes. This sector needs specialized, high-speed, along with automated machinery to guarantee food safety, extend shelf life, and even meet consumer need for convenience and aesthetic packaging, which, thus, drives consistent investment in advanced solutions.

Moreover, as more people move to cities along with disposable incomes rising, mainly in regions like the Asia Pacific and Latin America, the need for packaged foods increases. Environmental concerns together with regulations, are driving the industry to accept eco-friendly packaging machinery and even practices, like those using compostable or recyclable materials.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Packaging Machinery Market

- In May 2025, ProMach, a global leader in processing and packaging machinery and even related solutions, declared that it had obtained DJS Systems, a leader in disposable food service packaging automation. DJS Systems is a well-established and respected automation partner for a few of the best-known disposable food service packaging manufacturers in the US. The addition of DJS thus expands ProMach’s capabilities in this market.

- In March 2025, The IBA , a leading trade fair for confectionery, bakery, and snacks, opens its doors in Dusseldorf. Syntegon planned now to present a new handling solution for packaging cookies, as a leading manufacturer of highly automated, seamlessly integrated packaging systems, Moreover, the all-new Syntegon FGCT count feeder for cookies now will celebrate is European premiere.

Top Companies in the Packaging Machinery Market & Their Offering

- Tetra Laval International S.A.: Offers integrated solutions for processing, filling, and distributing food and beverages, primarily known for its advanced aseptic carton packaging technology via its subsidiary Tetra Pak.

- MULTIVAC Group: Specializes in packaging solutions for food, life sciences, and industrial products, with a diverse portfolio including thermoforming machines, traysealers, and chamber vacuum systems.

- Fuji Machinery Co., Ltd.: Provides a wide range of packaging machinery and integrated lines, from pillow and shrink wrappers to cartoning and box casing machines, with customization to meet specific customer needs.

- ProMach: A family of packaging solution brands offering a broad spectrum of equipment that covers nearly every function of a production line, including filling, capping, labeling, and end-of-line robotics.

- Syntegon Technology GmbH: Supplies processing and packaging solutions for the pharmaceutical, food, and confectionery industries, including vertical form-fill-seal machines, cartoning, and aseptic fill-finish equipment.

- Krones AG: A major supplier for the beverage and liquid food industries, providing individual machines and complete lines for producing, filling, labeling, and packaging glass bottles, PET containers, and cans.

- SIG Combibloc Group Ltd.: A systems and solutions provider primarily focused on aseptic carton packaging for the food and beverage industry, offering filling machines for cartons, bags, and pouches.

- ROVEMA GmbH: Specializes in vertical form-fill-seal (VFFS) machines, along with integrated solutions for dosing, cartoning, and end-of-line packaging for various sectors, including food and pharma.

- Maillis Group: The search results did not provide a recent or succinct description of Maillis Group's packaging machinery offerings; it is possible this information is not readily available or the company's focus has shifted.

- Robert Bosch GmbH: While historically a major player in packaging, their packaging division (Bosch Packaging Technology) was divested and is now Syntegon Technology GmbH; therefore, their current offering in this sector is minimal.

- Bradman Lake Ltd.: Designs and manufactures packaging machinery and turnkey systems for a variety of sectors, specializing in primary, secondary, and tertiary packaging equipment such as flow wrappers, cartoners, and case packers.

Segment Covered in the Report

By Machinery

- Filling Machine

- Labelling

- Palletizing

- Extrution Machine

- Bottling

- Cartoning Machines

- Others

By End User

- Food & Beverage

- Personal Care

- Pharmaceutical

- Chemical

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5115

Request a Custom Case Study and Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Pharmaceutical Packaging Machines Market Driven by AI, Smart Tech, and USD 13.63 Billion Forecast

- Japan Packaging Machinery Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- Beverage Carton Packaging Machinery Market 2025 Update Shows Leadership by Tetra Pak SIG and Other Global Players

- Snack Packaging Machine Market 2025 to 2034 USD 19.56 Billion to USD 29.39 Billion Growth with Rising Packaged Snack Demand

- Bagging Machines Market Trends, Disruptors, Competitive Strategy and Role of Key Players

- Augmented Reality in Packaging Market Size, Share, Trends and Segments

- Rice Paper Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Security Printing Services Market Size, Segments, Companies, Value Chain & Trade Analysis 2025-2034

- Blister Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Thermoform Packaging Market Size, Share, Trends, and Competitive Analysis 2025-2034

- Vacuum Packaging Market Size, Competitive Landscape, Key Manufacturers, and Suppliers Data 2034

- Digital Printing Packaging Market Size, Share, Segmentation, Trends, and Regional Performance (2025-2034)

- Feed Packaging Market Regional Insights, Segmentation, Materials, End Users and Key Players

- Food Packaging Technology and Equipment Market Size, Key Players, and Growth Prospects

- Agriculture Packaging Market Size, Key Segments by Material, End-Use, and Region and Competitive Landscape

- Water-Soluble Packaging Market Size, Share, Growth Forecast, Key Segments and Regional Insights (2025-2034)

- Liquid Packaging Market Size, Segmentation, Competitive Landscape, and Growth Opportunities (2025-2034)