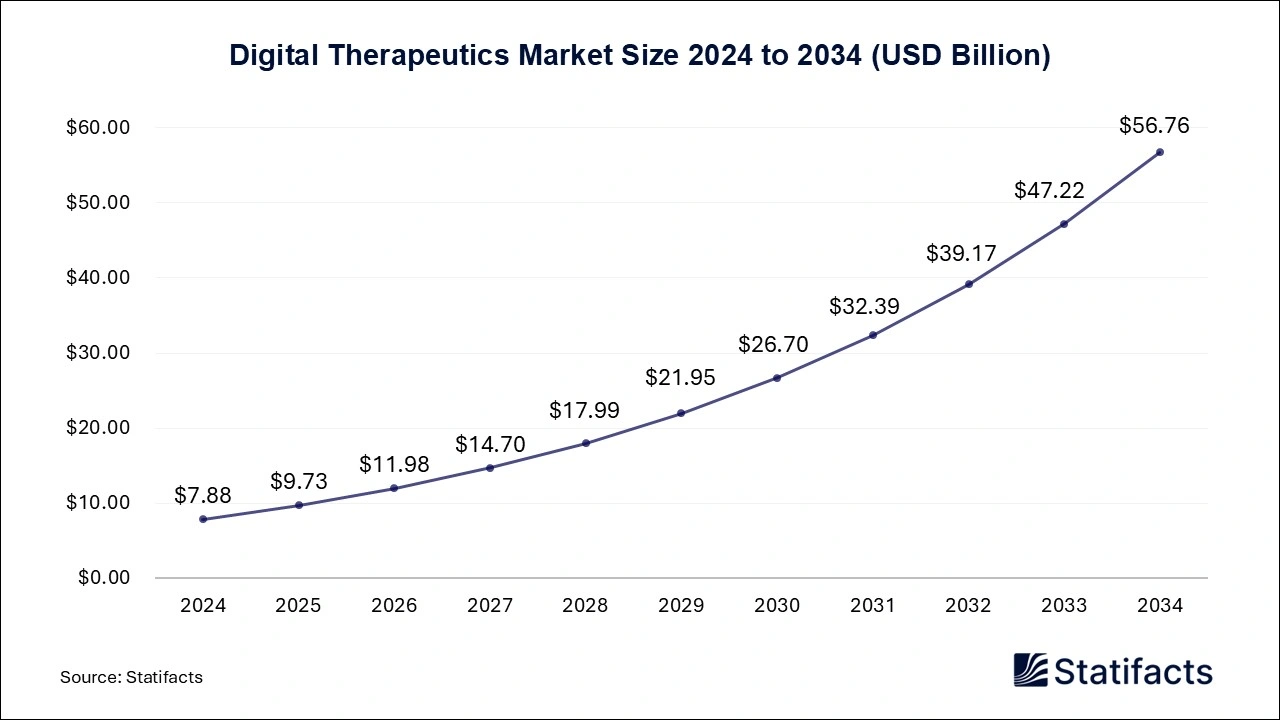

Digital Therapeutics Market Size to Lead USD 56.76 Bn by 2034 Driven by Digital Therapeutics, Cost Control, and Chronic Disease Prevalence

The global digital therapeutics market size is predicted to increase from USD 9.73 billion in 2025 and is anticipated to be worth around USD 56.76 billion by 2034, expanding at a CAGR of 21.83% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Oct. 07, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global digital therapeutics market size reached USD 7.88 billion in 2024 and is estimated to attain USD 56.76 billion by 2034, growing at a CAGR of 21.83% during the forecast period from 2025 to 2034. The rising popularity of digital therapeutics, the potential to increase the quality of care delivery, the increasing requirement for cost containment, and the rising prevalence of chronic diseases are driving the growth of the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8373

Digital Therapeutics Market Highlights

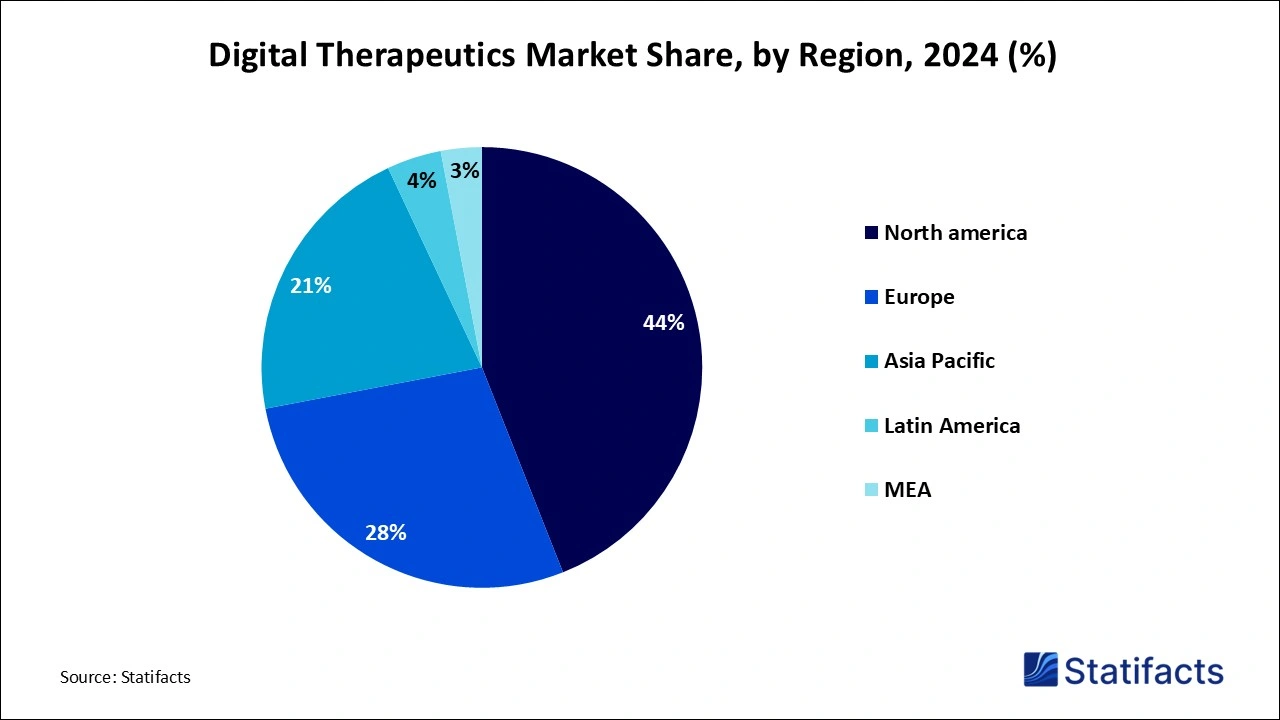

- North America maintained a leading market share of 44% in 2024, securing its position as the dominant region in the global market.

- Asia Pacific is projected to experience the fastest market growth from 2025 to 2034, driven by increasing healthcare investments and technological advancements.

- By product, the devices segment captured a significant 87% market share in 2024, fueled by the rising integration of wearable technologies and connected health tools.

- The software segment is expected to witness the highest growth rate between 2025 and 2034, as the demand for health management and analytics software continues to rise.

- By application, the diabetes segment led with a dominant market share of 26% in 2024, primarily due to the increasing prevalence of diabetes and advancements in diabetes management technologies.

- The obesity segment is predicted to experience significant growth over the next decade, driven by the rising global obesity rates and expanding digital health solutions.

- By sales channel, the business-to-business (B2B) segment accounted for 65% of the market share in 2024, benefiting from institutional sales to healthcare providers, insurers, and employers.

- The business-to-consumer (B2C) segment is anticipated to see rapid expansion in the coming years, driven by heightened consumer health awareness and the growing trend of direct app subscriptions for health management.

Digital Therapeutics Market Size, by Region, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| North America | 2,261.07 | 2,800.82 | 3,459.24 | 4,259.88 | 5,230.32 |

| Europe | 1,451.43 | 1,791.02 | 2,203.49 | 2,702.87 | 3,305.53 |

| Asia Pacific | 1,025.79 | 1,294.17 | 1,627.60 | 2,040.45 | 2,549.90 |

| Latin America | 206.72 | 257.75 | 320.44 | 397.19 | 490.88 |

| Middle East & Africa | 177.10 | 217.89 | 267.26 | 326.83 | 398.47 |

Digital Therapeutics Market Size, by Product, 2022 to 2026 (USD Million)

| Product | 2022 | 2023 | 2024 | 2025 | 2026 |

| Devices | 4,489.00 | 5,558.35 | 6,862.23 | 8,447.04 | 10,367.15 |

| Softwares | 633.10 | 803.30 | 1,015.80 | 1,280.18 | 1,607.94 |

Digital Therapeutics Market Size, by Sales Channel, 2022 to 2026 (USD Million)

| Sales Channel | 2022 | 2023 | 2024 | 2025 | 2026 |

| Business-to-Consumer | 1,769.53 | 2,209.04 | 2,749.57 | 3,412.26 | 4,222.11 |

| Business-to-Business | 3,352.57 | 4,152.61 | 5,128.46 | 6,314.96 | 7,752.99 |

Digital Therapeutics Market Size, by Application, 2022 to 2026 (USD Million)

| Application | 2022 | 2023 | 2024 | 2025 | 2026 |

| Obesity | 909.72 | 1,145.21 | 1,437.19 | 1,797.98 | 2,242.35 |

| Diabetes | 1,361.66 | 1,683.53 | 2,075.35 | 2,550.80 | 3,125.86 |

| CNS Disorders | 623.75 | 776.32 | 963.39 | 1,192.01 | 1,470.53 |

| Gastrointestinal Disorders | 580.40 | 723.58 | 899.42 | 1,114.70 | 1,377.42 |

| CVD Disease | 685.62 | 847.22 | 1,043.81 | 1,282.22 | 1,570.39 |

| Smoking Cessation | 229.47 | 282.54 | 346.85 | 424.51 | 517.99 |

| Respiratory Diseases | 422.58 | 527.63 | 656.84 | 815.28 | 1,008.91 |

| Others | 308.91 | 375.61 | 455.19 | 549.73 | 661.64 |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Market Challenges Facing Digital Therapeutics

Despite the rapid growth and potential of digital therapeutics, the industry faces several challenges. One of the primary hurdles is the complexity of regulatory approval. Regulatory bodies like the FDA and EMA are still developing frameworks for digital therapeutics, which can cause delays in market access. Furthermore, data privacy concerns remain significant, as digital therapeutics involve the collection and analysis of sensitive patient data. Ensuring that these products comply with strict data protection laws, like GDPR in Europe, is critical. Another challenge is the adoption rate among healthcare providers and patients. Although digital therapeutics offer convenience and personalized care, many patients are reluctant to rely on technology for their healthcare needs, especially in underserved or older demographics.

What is Digital Therapeutics?

The digital therapeutics market refers to the production, distribution, and use of digital therapeutics (DTx) that are evidence-based therapeutic interventions driven by software to prevent, manage, or treat a medical disorder or disease. Digital therapeutics (DTx) deliver medical interventions directly to patients using evidence-based, clinically evaluated software to treat, manage, and prevent a broad spectrum of disorders and diseases. Digital therapeutics are a part of digital health that deliver therapeutic interventions directly to patients through evidence-based, clinically evaluated software for disease management.

Digital therapeutics offers behavioral and cognitive interventions in place of specific conventional medicines, reducing drug toxicity. Therapy is delivered through wearable devices or smartphones, making it more accessible and mobile than traditional medicine and avoiding shortages of locations that offer therapy.

Key Government Initiatives for Digital Therapeutics:

- Germany’s DiGA Fast-Track under the Digital Healthcare Act (DVG) - Germany launched the Digital Healthcare Act (DVG) in 2019, creating the DiGA Fast-Track pathway, which allows certain digital health applications, including digital therapeutics, to be prescribed by physicians and reimbursed by statutory health insurance. Applications that meet safety, data protection, and clinical evidence standards can receive provisional approval while further data is collected.

- India’s Ayushman Bharat Digital Mission (ABDM) - India’s Ayushman Bharat Digital Mission aims to build a unified digital health ecosystem through health IDs, electronic health records, and interoperable digital infrastructure.

- European Union’s Medical Device Regulation (MDR) - The EU’s Medical Device Regulation has strengthened the oversight of software-based medical products, including digital therapeutics, by mandating more rigorous clinical evaluation and post-market surveillance. Broader EU initiatives like the European Health Data Space are also creating frameworks to support data-driven healthcare and DTx deployment across member states.

- National Reimbursement and App Validation Programs (e.g., Belgium, France, Germany) - Several countries have established digital health app validation and reimbursement programs to fast-track digital therapeutic adoption. Belgium’s mHealth Belgium platform and France’s reimbursement pilots offer structured pathways for evaluating, approving, and funding digital health apps, while Germany's DiGA system remains the most mature.

- United States’ Legislative and Regulatory Support for PDTs - In the U.S., initiatives like the Access to Prescription Digital Therapeutics Act seek to enable Medicare and Medicaid reimbursement for prescription digital therapeutics (PDTs).

Regulatory Advancements: FDA's Evaluation of AI-Enabled Digital Therapeutics for Mental Health

Background:

In September 2025, the U.S. Food and Drug Administration (FDA) held a critical meeting to evaluate the growing field of AI-enabled digital mental health devices. With the rising demand for mental health support, particularly in the wake of the COVID-19 pandemic, digital therapeutics have emerged as a scalable solution to address mental health conditions like anxiety, depression, and insomnia. The FDA's review focused on AI-based devices, such as virtual therapists and chatbots, that offer cognitive behavioral therapy (CBT) and other therapeutic interventions through digital platforms.

The Challenge:

Mental health disorders are a leading cause of disability globally, with limited access to care, particularly in underserved regions. Traditional therapy and medication-based approaches have limitations, including accessibility and cost. As the digital therapeutics space grows, so does the need for regulatory bodies to assess their efficacy and safety. The key challenge lies in establishing a comprehensive regulatory framework that ensures these AI-driven interventions are both effective and safe for patients.

The Solution:

The FDA's Digital Health Advisory Committee reviewed AI-enabled digital therapeutics, focusing on how these devices can serve as substitutes or complementary solutions to traditional treatments. The devices are designed to offer personalized, evidence-based interventions through the use of machine learning and behavioral health algorithms, improving patient outcomes without the need for in-person therapy sessions. These tools include virtual assistants that provide cognitive-behavioral therapy (CBT) for depression, AI-driven chatbots for anxiety management, and sleep therapy apps.

The committee's review sought to assess the following key aspects:

- Efficacy: Ensuring that the digital health devices produce measurable improvements in mental health, supported by clinical trials.

- Safety: Assessing the risks associated with AI algorithms, including ensuring data privacy and minimizing adverse effects.

- Regulatory Pathways: Identifying the steps necessary to fast-track the approval process while ensuring that safety and efficacy standards are met.

Outcome:

The FDA's review set the stage for clearer regulatory pathways for AI-enabled digital therapeutics in mental health. The meeting highlighted the need for continuous monitoring and post-market surveillance to ensure these devices maintain efficacy and safety over time. Following the evaluation, the FDA is expected to establish new guidelines for approving AI-based therapeutic devices, which will help drive the growth of digital therapeutics within the mental health industry.

Engagement Opportunity:

This case study is significant for stakeholders in digital therapeutics, AI, and mental health sectors. It addresses the regulatory challenges that could shape the future of AI-driven treatments. By focusing on regulatory approval and the use of AI for mental health management, this case study appeals to technology developers, healthcare providers, investors, and policymakers, encouraging conversations about the viability and oversight of digital therapeutics in mental healthcare.

Key Takeaways:

- Growth of AI in Digital Therapeutics: The case study emphasizes the growing role of AI in providing scalable, personalized mental health interventions.

- Regulatory Landscape: It illustrates the challenges and opportunities that come with regulating emerging digital health technologies.

- Impact on the Market: With clearer regulatory frameworks, the digital therapeutics market in mental health is expected to expand rapidly, addressing a significant public health need.

What are the Key Trends of the Digital Therapeutics Market?

- Integration with Wearables and Connected Devices: Digital therapeutics are increasingly being paired with wearables (e.g., smartwatches, glucose monitors, inhalers) to provide real-time data for more personalized and effective treatments. This integration allows for continuous monitoring, feedback loops, and adaptive interventions, enhancing treatment adherence and outcomes.

- Expansion of Regulatory Approvals and Reimbursement Pathways: Governments and health agencies (like the FDA and EMA) are increasingly approving digital therapeutics as legitimate, regulated treatments. At the same time, insurance companies and public health systems are beginning to cover DTx, driving wider adoption and market growth.

- Focus on Mental and Behavioral Health: There is a growing demand for DTx solutions targeting mental health, including anxiety, depression, insomnia, and substance use disorders. Companies are leveraging cognitive behavioral therapy (CBT) and AI-driven interventions to offer scalable mental health support.

- Chronic Disease Management at Scale: DTx is being widely adopted to manage chronic conditions like diabetes, hypertension, cardiovascular disease, and obesity. These platforms often combine coaching, remote monitoring, and AI-powered insights to support lifestyle changes and medication adherence.

- AI and Personalization in Therapeutic Interventions: Artificial intelligence and machine learning are enabling hyper-personalized treatment pathways, adjusting recommendations in real-time based on user behavior, biometrics, and progress. This enhances user engagement and clinical efficacy across diverse patient populations.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8373

Market Dynamics

Driver

- Rising prevalence of chronic diseases:

Chronic illness benefits include ensuring we are covered for specific life-threatening conditions like heart disease or diabetes that need ongoing treatment. When a chronic condition is managed effectively, it will likely result in fewer acute and long-term medical complications or side effects. Good management of chronic conditions can prevent or delay complications and slow the progression of our disease. In terms of chronic diseases, digital therapeutics are primarily designed for diabetes and cardiovascular diseases.

Restraint

- Lack of skilled IT professionals:

Lack of skilled IT professionals may result in higher turnover rates, creating additional costs in recruitment, training, and the loss of valuable institutional knowledge. When employees feel unprepared or undervalued due to skill gaps, morale and job satisfaction plummet. The impact of skills shortage extends beyond operations; it profoundly affects workforce morale and employee retention. When companies lack skilled talent, existing employees may be burdened with extra workloads, leading to burnout, stress, and disengagement.

Opportunity

- Adoption of digital health technologies:

Digital health technologies have the potential to improve healthcare access and equity by providing remote care. The purpose of a global strategy on digital health is to promote healthy lives and well-being for everyone, everywhere, at all stages. Digital health technologies expanded access to healthcare for historically marginalized communities. Improving the use of digital technologies and data allows informed decision-making, providing people with better access to their health information when and where they need it, improved quality of care, and personalized health outcomes.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8373

Digital Therapeutics Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 7.88 Billion | |

| Market Size in 2025 | USD 9.73 Billion | |

| Market Size in 2031 | USD 32.39 Billion | |

| Market Size by 2034 | USD 56.76 Billion | |

| CAGR 2025-2034 | 21.83% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Product, By Sales Channel, By Application and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | Fitbit Health Solutions, 2MORROW Inc., Medtronic Plc., Livongo Health Inc., Pear Therapeutics Inc., Omada Health Inc., Resmed Inc . (Propeller Health), Proteus Digital Health Inc., Welldoc Inc., Voluntis Inc., Canary Health Inc, Noom Inc., Mango Health Inc., Dthera Sciences, and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Digital Therapeutics Market Segmentation

Product Insights

Why Does the Devices Segment Dominate the Digital Therapeutics Market?

The devices segment dominated the market in 2024. A digital therapy machine can work longer hours at less cost than human therapists. Digital technologies like wearable devices, health apps, and telemedicine facilitate continuous patient monitoring, personalized treatment plans, and enhanced engagement. Digital therapy machines use electrical impulses to stimulate nerves and muscles, which can help reduce pain, enhance blood circulation, and promote muscle relaxation. It generally offers multiple modes and intensity levels for customized therapy.

The software segment is projected to experience the highest growth rate in the market between 2025 and 2034. New digital therapy reduces anxiety and depression in people living with long-term physical health conditions. A new King’s College London study finds, a therapist's guided digital cognitive behavioral therapy reduced distress in 89% of participants living with long-term physical health conditions. Digital therapeutics (DXs) are patient-facing software applications that help patients treat, prevent, or manage a disease and that have proven clinical benefit.

Sales Channel Insights

Why Does the Business-to-Business (B2B) Segment Dominate the Digital Therapeutics Market?

The business-to-business (B2B) segment dominated the market share in 2024. The business-to-business (B2B) sales channel benefits include developing product and industry knowledge, convenient account management, competitive pricing, better customer service, wider market reach, offloading international distribution, lower customer acquisition costs, increased self-service, analytics, and cost reduction. The segment is experiencing further growth due to a complex buying process, B2B ecommerce, advanced marketing strategies, scalability, improved efficiency, and easier-to-scale business operations. The automated sales and business processes, reduced operational costs, higher order value and volume, and improved personalization & customer experience, further add to this growth.

The business-to-consumer (B2C) segment is projected to expand rapidly in the market in the coming years. The benefits of business to consumer include a stronger brand loyalty, a single catalog, personalization, making marketing easier, less technical overhead, increasing revenue, increasing prices, improving customer relationships, improving margins, and expanding business operations. The segment is maturing rapidly, with consumers preferring to buy direct, boosting innovation, a personalized shopping experience, improved customer experience, brand control, owning customer data, lower prices, increased reach, and more.

Application Insights

How does Diabetes Segment Lead the Digital Therapeutics Market?

The diabetes segment led the market in 2024. With digital therapeutics, patients can track their physical activity, blood glucose levels, and medication adherence in real-time. Digital therapeutics have improved patient compliance, therapeutic success, and economic outcomes in diabetes management. These enable active patient engagement, promoting lifestyle changes, providing comprehensive medical care, and facilitating periodic monitoring of glycemic status.

- In January 2025, the combined diabetes care technology provision in the UK to improve support for diabetic patients who require bolus insulin dosing support in their daily management was launched by Glooko and Danish digital therapeutics company Hedia. Glooko’s platform allows patients to share diabetes data, including insulin doses, blood glucose, and blood pressure, with their healthcare providers. Source: Medical Device Network

The obesity segment is expected to grow fastest over the forecast period. Digital therapeutics technologies allow us to monitor and manage our physical and mental health in our daily lives. Studies on digital therapeutic technologies for the self-management of obesity have found that they can enhance compliance and effectiveness in managing obesity. Digital technologies are transforming the management of obesity for patients and healthcare systems.

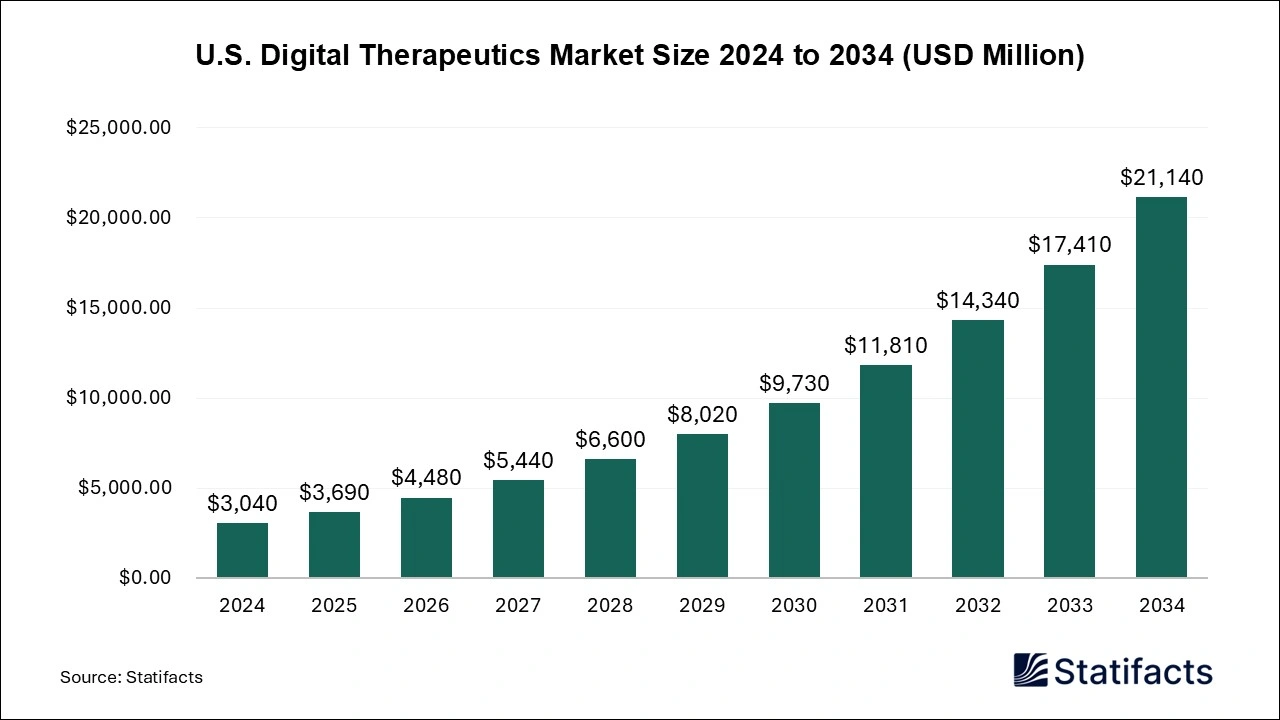

U.S. Digital Therapeutics Market Size and Growth 2025 to 2034

The U.S. digital therapeutics market size was estimated at USD 3,040 million in 2024 and is predicted to be worth around USD 21,140 million by 2034, registering a solid CAGR of 21.4% from 2024 to 2034.

Why is North America leading the global Digital Therapeutics Market?

North America maintained a leading position in the market in 2024 due to the rising demand for digital therapeutics, potential to improve the quality of care delivery, technological innovations, demand for personalized and remote care, increased digital adoption, prevalence of chronic diseases, increasing adoption of smartphones, and rising prevalence of chronic diseases like diabetes and mental health conditions in the region. Digital therapeutics provide innovative treatment options. In the United States, psychiatric disorders represent a major public health challenge and contribute to significant morbidity and healthcare costs.

The U.S. is a major player in the regional market, due to its well-established regulatory framework, robust healthcare infrastructure, and high adoption of digital health technologies. The U.S. Food and Drug Administration (FDA) has pioneered the approval of software-based medical treatments, enabling faster market access for digital therapeutics. Additionally, a strong ecosystem of innovation, fueled by venture capital, startups, and major tech players, supports rapid development. High prevalence of chronic diseases like diabetes, obesity, and mental health disorders drives demand, while increasing payer support and reimbursement pathways make digital therapeutics financially viable.

Asia Pacific Digital Therapeutics Market Trends

Asia Pacific is set to experience the fastest rate of market growth from 2025 to 2034 due to the growing investment in digital health technologies, supportive regulatory frameworks, need for remote and integrated healthcare systems, technological innovation, increased access to smartphones and internet penetration, growing health consciousness, demand for personalized & evidence-based therapies, and increasing chronic disease prevalence.

- In July 2025, to offer personalized digital therapeutics, Indian startup Zyla Health expanded in Southeast Asia. This expansion is effective and has strong traction, resulting from Zyla’s digital treatment solution among cardiometabolic patients. Source: Bio Spectrum Asia

Country-Level Investments & Funding in the Digital Therapeutics Industry

- United States - The NIH has more than tripled its funding for digital health technology research over about 8 years, growing from US$348 million in fiscal year 2015 to US$1.5 billion in FY 2023. This funding covers a broad spectrum of digital health tools, including software, wearable devices, telemedicine, and other digital therapeutic modalities.

- The UK - Several UK government programmes have allocated multi-million-pound investments into digital therapeutics / digital mental health innovations. Innovate UK committed £3.6 million to projects developing extended reality (XR) based therapeutic solutions for moderate to severe mental health conditions.

- Australia - Australia has committed A$135.2 million to its Digital Mental Health Program (over multiple years) to expand access to free or low-cost digital mental health supports. This includes funding for 12 different services, with special attention to culturally and linguistically diverse communities, young people, and other priority groups.

- Germany - Germany’s government supports digital therapeutics both via regulatory and reimbursement policy (DiGA) and via direct funding for their development. The Innovation Fund (Innovationsfonds) under the statutory health insurance system helps support novel medical services and patient-oriented health interventions, which include digital health applications. It can fund up to 100% of development costs in certain eligible cases.

- India - The Indian government has floated Expressions of Interest (EOIs) under its “PRIP” scheme to fund R&D in the pharma-medtech sector (which includes digital therapeutics and related technologies). Under this scheme, bigger companies may receive funding up to ₹125 crore, while startups may secure smaller amounts (~₹1 crore), depending on milestones over a period.

Browse More Research Reports:

- The global peptide therapeutics market size was estimated at USD 49.13 billion in 2024 and is projected to be worth around USD 83.75 billion by 2034, growing at a CAGR of 5.47% from 2025 to 2034.

- The global prostate cancer therapeutics market size accounted for USD 13,420 million in 2024 and is predicted to touch around USD 30,910 million by 2034, growing at a CAGR of 8.7% from 2025 to 2034.

- The global pain management therapeutics market size was valued at USD 85.19 billion in 2024 and is expected to hit around USD 124.89 billion by 2034 with a CAGR of 3.9% from 2025 to 2034.

- The tissue dissociation market size accounted for USD 318 million in 2024 and is expected to exceed around USD 899.69 million by 2034, growing at a CAGR of 10.96% from 2025 to 2034.

- The global infectious disease therapeutics market size accounted for USD 123.93 billion in 2024 and is predicted to touch around USD 181.69 billion by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

- The U.S. mRNA therapeutics market size accounted for USD 5,150 million in 2024 and is expected to exceed around USD 12,300 million by 2034, growing at a CAGR of 9.1% from 2025 to 2034.

- The glaucoma therapeutics market size was valued at USD 6,162 million in 2024 and is predicted to gain around USD 10,037 million by 2034 with a CAGR of 5%.

- The global lung cancer therapeutics market size is predicted to gain around USD 66.56 billion by 2034 from USD 33.84 billion in 2024 with a CAGR of 7%.

- The alzheimer's therapeutics market size projected to grow from USD 4.90 billion in 2024 to USD 8.60 billion by 2034, with a CAGR of 5.8%.

- The post-traumatic stress disorder (PTSD) therapeutics market valued at USD 2.51 bn in 2024 and projected to reach USD 3.69 bn by 2034, at a CAGR of 3.9%.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8373

Top Companies in the Digital Therapeutics Market

- Fitbit Health Solutions - Fitbit Health Solutions offers digital health tools that use wearable technology to promote physical activity, sleep improvement, and chronic disease management through personalized data insights.

- 2MORROW, Inc. - 2MORROW, Inc. delivers evidence-based digital therapy programs focused on behavioral health, including smoking cessation, weight management, and stress reduction.

- Medtronic Plc. - Medtronic integrates digital therapeutics into its chronic disease management systems, particularly in diabetes care, offering connected insulin delivery and remote monitoring tools.

- Livongo Health, Inc. - Livongo provides a digital platform for managing chronic conditions like diabetes and hypertension using AI-driven personalized insights and real-time health coaching.

- Pear Therapeutics, Inc. - Pear Therapeutics is a pioneer in prescription digital therapeutics (PDTs), offering FDA-approved software-based treatments for substance use disorder, opioid use disorder, and insomnia.

- Omada Health, Inc. - Omada Health delivers digital care programs that combine behavior science, clinical protocols, and personal coaching for chronic disease prevention and management.

- ResMed, Inc. (Propeller Health) - Through its Propeller Health subsidiary, ResMed offers digital respiratory health solutions that track inhaler use and environmental data to improve asthma and COPD management.

- Proteus Digital Health, Inc. - Proteus Digital Health developed ingestible sensors and digital medicine platforms that monitor medication adherence and patient health metrics in real-time.

- Welldoc, Inc. - Welldoc’s digital therapeutic platform, such as BlueStar®, offers real-time, personalized diabetes self-management support through AI-powered mobile applications.

- Voluntis , Inc. - Voluntis creates digital therapeutics that support patients with cancer and diabetes by guiding treatment decisions and improving therapy adherence.

- Canary Health Inc. - Canary Health provides digital self-management programs for chronic conditions like diabetes and arthritis, with a strong focus on peer support and behavioral coaching.

- Noom, Inc. - Noom combines psychology, AI, and mobile technology to deliver weight loss and healthy living programs focused on long-term behavior change.

- Mango Health Inc. - Mango Health offers a mobile app that encourages medication adherence and healthy behaviors using gamification and personalized reminders.

- Dthera Sciences - Dthera Sciences develops digital therapeutics for Alzheimer’s and other cognitive disorders, using AI-driven reminiscence therapy to enhance emotional well-being in elderly patients.

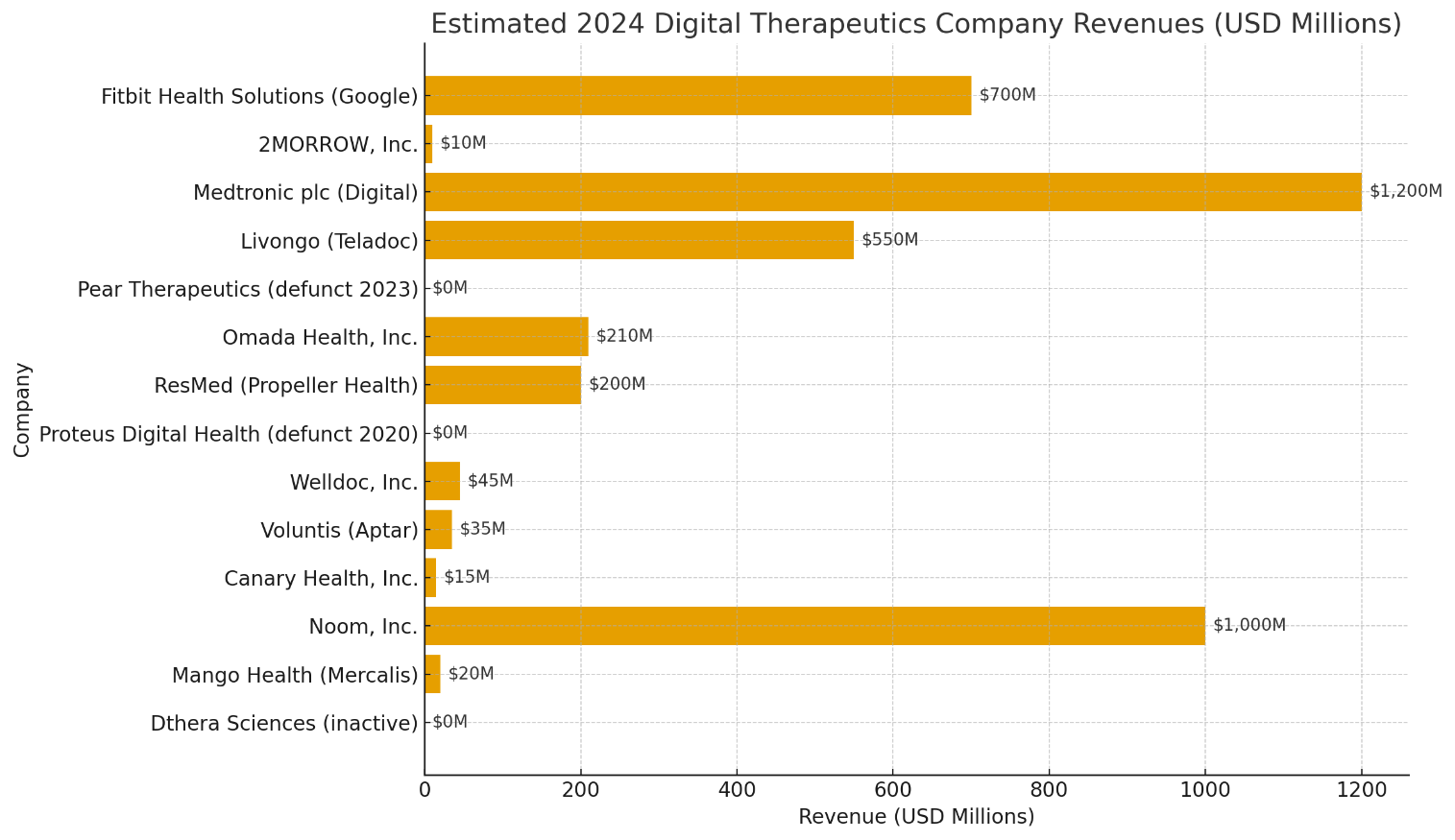

The Digital Therapeutics (DTx) Market is characterized by a few high-revenue players integrated within large healthcare or tech ecosystems (like Alphabet , Medtronic , and Teladoc) and a long tail of smaller, niche-focused companies. The revenue data below represents estimated 2024 figures in USD millions (based on public filings, acquisition reports, and credible industry analyses).

Estimated 2024 Revenues by Company

| Rank | Company | 2024 Revenue (USD Million) | Notes / Highlights |

| 1 | Medtronic plc (Digital & Connected Care) | $1,200 M | Medtronic ’s digital platforms, CGMs, and connected insulin pumps dominate the DTx-linked medical devices space. The firm leverages clinical hardware with software integration technically broader than pure DTx, but included due to its algorithm-driven therapeutic delivery. |

| 2 | Noom, Inc. | $1,000 M | One of the largest consumer-facing behavioral DTx brands. Noom operates on a subscription-based weight management model, reporting nearly $1 B annual recurring revenue (ARR) by late 2023, driven by global app subscriptions. |

| 3 | Fitbit Health Solutions ( Alphabet ) | $700 M | Fitbit ’s health arm under Alphabet combines wellness and chronic care monitoring via wearable-integrated DTx platforms. It contributes meaningfully to Alphabet ’s Health and Fitbit revenue streams, particularly in cardiometabolic and lifestyle management. |

| 4 | Livongo Health (Teladoc Health) | $550 M | Now fully integrated into Teladoc Health, Livongo continues to serve chronic care management for diabetes and hypertension. Its DTx modules represent a significant share of Teladoc’s chronic condition revenue. |

| 5 | Omada Health, Inc. | $210 M | Among the few standalone DTx specialists with sustained revenue growth (~38% YoY). Omada’s platform spans diabetes prevention, MSK (musculoskeletal) care, and hypertension, with a strong payer/employer base. |

| 6 | ResMed (Propeller Health) | $200 M | Propeller Health, acquired by ResMed, dominates respiratory DTx (asthma, COPD). Its revenue reflects integration within ResMed’s connected solutions segment. |

| 7 | Welldoc, Inc. | $45 M | Known for its BlueStar diabetes management app, Welldoc partners with payers and pharma companies for digital chronic care, though its revenue scale remains moderate. |

| 8 | Voluntis (Aptar Group) | $35 M | Following its acquisition by Aptar, Voluntis contributes DTx solutions in oncology and diabetes, integrated into Aptar’s digital health ecosystem. |

| 9 | Mango Health (Mercalis / TrialCard) | $20 M | Focused on medication adherence DTx, operating under Mercalis since acquisition; small-scale, but growing in patient engagement programs. |

| 10 | Canary Health, Inc. | $15 M | Specializes in chronic disease self-management (especially arthritis, diabetes, and COPD) with partnerships in U.S. healthcare systems; niche presence. |

| 11 | 2MORROW, Inc. | $10 M | Focuses on behavioral change (smoking cessation, weight loss) through evidence-backed digital programs; operates primarily in employer and payer segments. |

Recent Developments

- In April 2025, an integrated digital health solution to better support people with obesity was launched by Ypsomed and Sidekick Health. To help patients using GLP-1-based injectable therapies manage their treatment more effectively, Ypsomed ’s autoinjectors consistently integrate into Sidekick’s digital health and chronic condition support app. Source: PR Newswire

- In April 2025, the FDA Marketing Authorization for CT-132, the first prescription digital therapeutic for the preventive treatment of episodic migraine in the United States, was announced by Click Therapeutics, Inc., a leader in prescription medical treatments as both prescription digital therapeutics and software-enhanced drug therapies. It is used in acute and other preventive treatments for migraine. Source: Business Wire

- In August 2024, the first digital therapeutic, an app-based treatment for major depressive disorder, was launched by Otsuka’s digital health subsidiary. This app, known as Rejoyn, is available only by prescription, and it is used in addition to medications. It consists of a six-week program with cognitive behavioral therapy-based video lessons and exercises for emotion identification. Source: MedTech Dive

Segments Covered in the Report

By Product

- Device

- Software AG

By Sales Channel

- Business to Consumer (B2C)

- Caregiver

- Patient

- Business to Business (B2B)

- Healthcare Provider

- Employer

- Others

By Application

- Obesity

- Diabetes

- Central Nervous System (CNS) Disease

- Gastrointestinal Disorder (GID)

- Cardiovascular Disease (CVD)

- Smoking Cessation

- Respiratory Disease

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

- Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Vitamin D Market - https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market - https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market - https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market - https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market - https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market - https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market - https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market - https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

- Quantum Encryption Communication Modules Market - https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market - https://www.statifacts.com/outlook/automotive-copper-core-cable-market