Plastic Pigments Market Anticipated to Hit USD 25.27 Billion by 2032, Driven by Surge in Bio-Based and Flame-Retardant Pigments | Research by SNS Insider

The rise in demand for plastic pigment-based products continues to accelerate due to advancements in polymer technology and increasing consumer focus on product aesthetics.

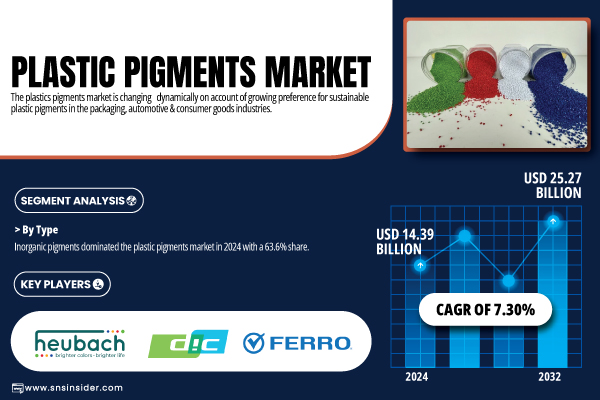

Austin, July 15, 2025 (GLOBE NEWSWIRE) -- The Plastic Pigments Market Size was valued at USD 14.39 billion in 2024 and is expected to reach USD 25.27 billion by 2032, growing at a CAGR of 7.30% over the forecast period of 2025-2032.

Innovations and rising plastic demand shape growth in the plastic pigments market across packaging, automotive, and consumer goods applications

The plastic pigments market is thriving, fueled by rising plastic consumption in packaging, automotive, and construction. The American Chemistry Council reported U.S. plastic resin production hitting 123 billion pounds in 2023, while Exxon Mobil ’s expansion of high-performance polyethylene supported pigment demand for colorful, durable applications. Packaging alone made up over half of U.S. plastic use, according to the Plastics Industry Association. In early 2024, BASF introduced heat-resistant inorganic pigments for automotive needs, highlighting how technological advancements and evolving consumer preferences continue to strengthen market momentum.

Download PDF Sample of Plastic Pigments Market @ https://www.snsinsider.com/sample-request/7757

The U.S. Plastic Pigments market is valued at USD 7.35 billion in 2024 and is projected to reach a value of USD 11.57 billion by 2032, with a CAGR of approximately 7.30% in the forecast period of 2025 to 2032.

The U.S. market benefits from strong packaging and automotive demand, growing at a steady pace driven by investments in sustainable pigments and high-performance solutions. According to the Plastics Industry Association, color masterbatches remain central in meeting evolving consumer preferences and design trends.

Key Players:

- Heubach GmbH

- DIC Corporation

- Sun Chemical (a subsidiary of DIC Corporation)

- Ferro Corporation

- Pidilite Industries Limited

- Tokan Material Technology Co., Ltd.

- Meghmani Organics Ltd.

- Neelikon Food Dyes & Chemicals Ltd.

- Trust Chem Co., Ltd.

- Kolorjet Chemicals Pvt. Ltd.

Plastic Pigments Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 14.39 billion |

| Market Size by 2032 | USD 25.27 billion |

| CAGR | CAGR of 7.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Surging adoption of bio-based plastic colorants fuels sustainable innovation. • Increased use of flame-retardant pigments driven by stricter safety regulations. |

If You Need Any Customization on Plastic Pigments Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7757

By Type, Inorganic Pigments dominated the Plastic Pigments Market in 2024, with a 63.6% Market Share.

The dominance is due to superior heat stability, weather resistance, and cost-effectiveness over organic pigments. Widely used in automotive coatings, outdoor furniture, and construction, inorganic pigments offer high opacity and UV resistance crucial for packaging. Tronox Holdings expanded titanium dioxide production in 2023, while Venator Materials reported higher sales driven by packaging and consumer goods demand. Continuous R&D into lead-free alternatives and compliance with food-contact standards further strengthen the segment’s appeal across regulated and performance-critical applications.

By Application, the Packaging Application dominated the Plastic Pigments Market in 2024 with a 38.7% Market Share.

The dominance is due to rising demand for colored plastics in food containers, films, and cosmetics, alongside brand differentiation needs. Companies like Berry Global increased production of vibrant, recyclable packaging to meet sustainability goals and consumer expectations. Pigments enhance shelf appeal and product identity, while regulations favoring recyclability drive high-performance pigment demand. E-commerce growth and retail-ready packaging trends also require pigments delivering consistent color quality across large volumes, solidifying packaging as the leading application.

By Region, Asia-Pacific dominated the Plastic Pigments Market in 2024, Holding a 38.6% Market Share.

The dominance is due to rapid industrialization, high plastics production, and strong local consumption across automotive, electronics, and packaging. China and India ramped up pigment output to meet this demand, while Japan’s DIC Corporation introduced eco-friendly pigments in 2023. The China Plastics Processing Industry Association highlighted surging domestic plastic production, further boosting pigment needs. Well-developed supply chains, cost-effective manufacturing, and innovation tailored to local and export markets firmly position Asia-Pacific as the market’s largest regional hub.

Recent Developments

- In March 2025, Tronox Holdings announced its intent to idle its TiO₂ pigment plant in the Netherlands, optimizing global capacity and aligning production with shifting end‑market demand.

- In September 2024, Vibrantz Technologies announced the upcoming construction of a dedicated facility for its Pearls solid‑colorant tinting system, targeting more efficient, eco‑friendly plastic colorant production.

Buy Full Research Report on Plastic Pigments Market 2025-2032 @ https://www.snsinsider.com/checkout/7757

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)