Global Respiratory Syncytial Virus Treatment Market Size To Reach USD 8,332.5 Million by 2033 | Astute Analytica

The global respiratory syncytial virus respiratory syncytial virus treatment market is undergoing rapid growth, driven by rising vaccine uptake, improved diagnostics, growing public awareness, and sustained investment in R&D. Respiratory syncytial virus(RSV), a single-stranded RNA virus from the Paramyxoviridae family, is a major cause of respiratory infections, particularly severe in infants, the elderly, and immunocompromised individuals. While symptoms often begin mildly, they can escalate to bronchiolitis, pneumonia, or respiratory failure. The virus spreads through droplets and contaminated surfaces, remaining viable for extended periods, contributing to high transmission rates.

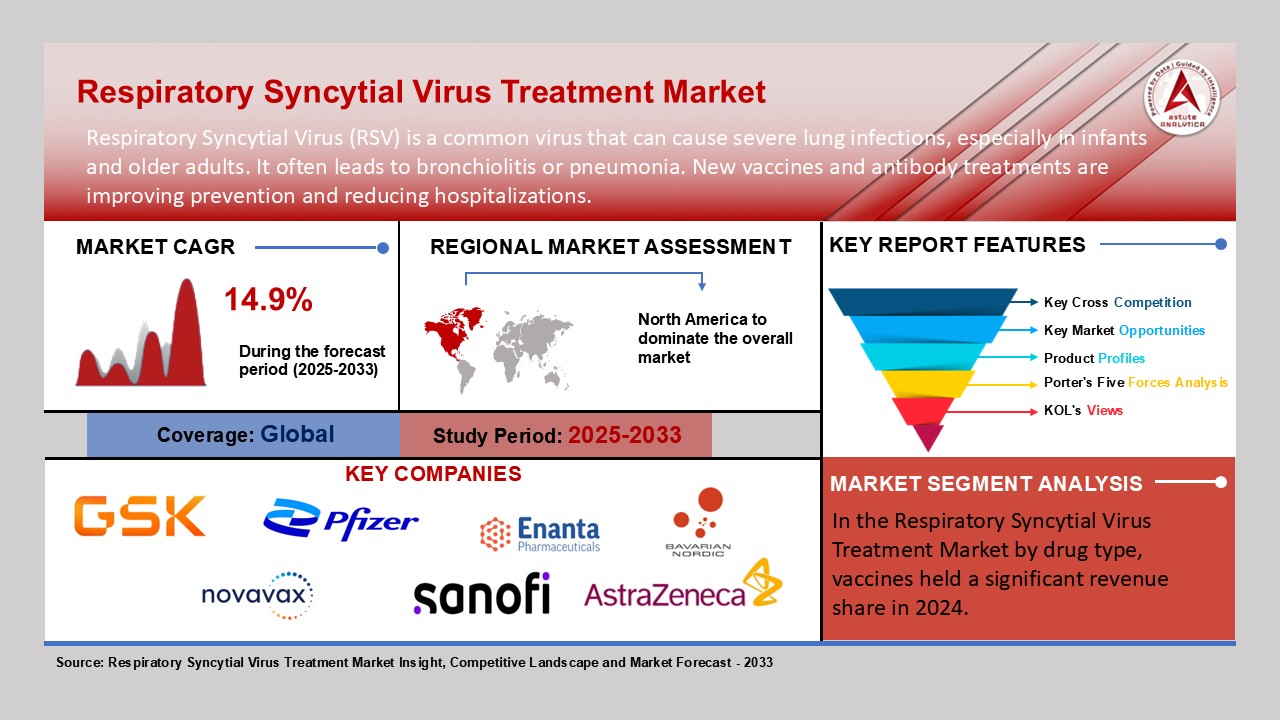

Chicago, June 09, 2025 (GLOBE NEWSWIRE) -- The global respiratory syncytial virus treatment market valued at USD 2,387.2 million in 2024 and is projected to reach USD 8,332.5 million by 2033, growing at a CAGR of 14.9%. Children under five years represent the most affected group, with over 30 million cases globally each year, leading to 3.2 million hospitalizations and 100,000 deaths, 97% of which occur in low- and middle-income countries (LMICs). In the U.S., respiratory syncytial virus (RSV) is responsible for up to 160,000 hospitalizations and 10,000 deaths annually among adults aged 65 and older. While mild in most adults, the virus poses serious risks to vulnerable populations. Gender distribution is nearly even, though slightly higher in males.

Download Sample Pages: https://www.astuteanalytica.com/request-sample/respiratory-syncytial-virus-market

Currently, no specific antiviral treatment for respiratory syncytial virus (RSV) is approved, and disease management remains limited to supportive care such as oxygen therapy, intravenous fluids, mechanical ventilation, and the use of broad-spectrum antivirals like ribavirin. Although respiratory syncytial virus (RSV) infection is often self-limiting, in the absence of timely care, it can result in severe illness and hospitalization, particularly in LMICs. These countries report more than 1.8 million respiratory syncytial virus (RSV)-related hospitalizations annually, underscoring the urgent need for effective and affordable prevention solutions. Preventive measures are centered around monoclonal antibodies (mAbs) and maternal vaccines. mAbs such as nirsevimab are administered to infants shortly after birth, while maternal vaccination during pregnancy provides passive immunity to newborns. According to a 2024 CDC survey, 33% of eligible pregnant women in the United States received the respiratory syncytial virus (RSV) vaccine, and among those who had a live birth, 45% reported their infant received nirsevimab. Overall, 56% of infants were protected against severe respiratory syncytial virus (RSV) through either maternal vaccination or the administration of monoclonal antibodies.

The respiratory syncytial virus treatment market is also experiencing momentum from new product approvals and launches. In 2023, Arexvy became the first respiratory syncytial virus (RSV) vaccine to receive regulatory approval. Approved in over 50 countries for use in older adults, Arexvy has emerged as a market leader in the U.S., generating multi-million-dollar revenues and setting a precedent for further product development. This success has accelerated innovation across the sector, leading to a robust pipeline of vaccine and antibody candidates under clinical evaluation. The significant disease burden associated with respiratory syncytial virus (RSV) and rising public awareness have contributed to increasing adoption of preventive measures. In the U.S. alone, respiratory syncytial virus (RSV) accounts for approximately 2.1 million outpatient visits and between 58,000 to 80,000 hospitalizations each year among children under five, highlighting the need for effective prophylaxis. As a result, respiratory syncytial virus (RSV) vaccination has been integrated into the CDC's Adult Immunization Schedule and the Immunization Schedule for Pregnant Individuals. Focused efforts continue to develop innovative therapeutics that address the needs of the most vulnerable populations, particularly infants and older adults.

However, high costs remain a key barrier in LMICs. Products like Beyfortus and Abrysvo cost USD 414.75 and USD 230.00 per dose, respectively, placing them out of reach for many. The WHO stresses the need for affordable respiratory syncytial virus (RSV) vaccines, particularly for maternal and early-childhood use, to reduce mortality and bridge global health disparities.

Despite these challenges, the respiratory syncytial virus treatment market is poised for sustained growth, propelled by expanding clinical applications, regulatory momentum, and rising global focus on prevention. Industry efforts to increase affordability and accessibility are expected to drive broader adoption and innovation worldwide.

Key Findings in the Respiratory Syncytial Virus Treatment Market

| Market Forecast (2033) | USD 8,332.5 |

| CAGR | 14.9% |

| Top Driver | The significant disease burden serves as the primary driver for recommending respiratory syncytial virus (RSV) vaccination |

| Top Challenge | Expensive respiratory syncytial virus (RSV) prevention limits access in developing countries |

| Top Trend | Advancing respiratory syncytial virus (RSV) Defense Through Combined Vaccine Strategies |

Opportunity: Enhancing respiratory syncytial virus (RSV) Prevention with Combination Vaccines

The arrival of respiratory syncytial virus respiratory syncytial virus (RSV) vaccines is a major step forward in preventing respiratory illnesses. The next big advance could be combination vaccines. Building on the success of recent respiratory syncytial virus(RSV) vaccines, companies like AstraZeneca and Moderna are now creating vaccines that protect against respiratory syncytial virus (RSV) along with other diseases such as COVID-19, human metapneumovirus (hMPV), and influenza.

For instance, Icosavax (now part of AstraZeneca) is concentrating on a combined respiratory syncytial virus(RSV) and hMPV vaccine. Meanwhile, Moderna is developing mRNA-1230, a multi-target vaccine in Phase I trials designed to guard against influenza, COVID-19, and respiratory syncytial virus (RSV). AstraZeneca also has IVX-A12, a Phase II candidate that provides dual protection against respiratory syncytial virus (RSV) and hMPV.

Although these candidates are still in early to mid-stage clinical trials, they offer significant promise in the respiratory syncytial virus treatment market. By delivering protection against multiple diseases in a single shot, they could mean fewer injections for patients and healthcare providers, potentially increasing vaccination rates. For pharmaceutical companies, this also presents a strategic opportunity to capture a larger share of the respiratory vaccine market.

Regional Dynamics: Global Landscape of Respiratory Syncytial Virus Treatment Expansion

The global respiratory syncytial virus respiratory syncytial virus treatment market is expanding rapidly, driven by rising disease burden, vaccination rollouts, and regional health initiatives. North America leads the market, supported by early vaccine approvals, strong R&D funding, and robust healthcare infrastructure. In the U.S., respiratory syncytial virus (RSV) remains a major concern. In 2024, CDC estimates indicated 3.6 to 6.5 million outpatient visits, 190,000 to 350,000 hospitalizations, and up to 23,000 deaths annually, mainly among infants and the elderly. The CDC’s targeted vaccination guidelines reflect a proactive and prevention-focused strategy.

Europe follows closely, with significant respiratory syncytial virus (RSV)-related hospitalizations. Over 213,000 children under five are hospitalized annually across the EU, UK, and Norway. Older adults are also increasingly affected. In response, countries such as the UK launched national immunization programs in 2024 targeting pregnant women and seniors, signalling a strong public health commitment.

Meanwhile, the Asia Pacific region faces a growing respiratory syncytial virus (RSV) burden, especially in China, Japan, and South Korea. However, limited surveillance data, particularly for older populations, hampers precise assessment. In developing countries like India, underdiagnosis is common due to low testing availability and overlapping respiratory symptoms. Low awareness and fragmented policy frameworks further constrain response efforts.

In the Middle East and Africa, data remains sparse, but isolated findings underscore respiratory syncytial virus (RSV) significance. In Saudi Arabia, a 2021 study found respiratory syncytial virus (RSV) in 23.5 percent of paediatric acute respiratory cases. National protocols such as the SIBRO guidelines are emerging, but broader implementation remains uneven across the region.

As respiratory syncytial virus (RSV) garners global recognition, regional disparities in diagnostics, policy, and access will continue to shape the market's trajectory and response strategies.

Need Custom Data? Let Us Know: https://www.astuteanalytica.com/ask-for-customization/respiratory-syncytial-virus-market

Recent Developments and Key Players in the respiratory syncytial virus (RSV) Vaccine Market

Several prominent players, including Moderna, Sanofi, GSK, AstraZeneca, Pfizer , Enanta Pharmaceuticals, Inc., Bavarian Nordic , Novavax, and BlueWillow Biologics, are driving innovation in the respiratory syncytial virus (RSV) vaccine market, contributing to a notable decline in respiratory syncytial virus (RSV)-related cases and hospitalizations among infants.

1) On May 8, 2025, the U.S. Centers for Disease Control and Prevention (CDC), through its Morbidity and Mortality Weekly Report, reported a significant reduction in respiratory syncytial virus (RSV) cases among infants aged 0-7 months during the October 2024 to February 2025 season, compared to the 2018–2020 period. This decline closely followed the rollout of maternal respiratory syncytial virus (RSV) vaccines and the use of the monoclonal antibody nirsevimab, resulting in a 43% reduction in hospitalization rates according to respiratory syncytial virus (RSV)-NET and a 28% reduction as reported by the New Vaccine Surveillance Network (NVSN).

2) Continuing the momentum, Pfizer ’s ABRYSVO received European Union approval on April 1, 2025, for adults aged 18-59 with lower respiratory tract disease. Based on Phase 3 MONet (NCT05842967) trial results, ABRYSVO demonstrated safety, strong tolerability, and robust immune response. With this latest approval, ABRYSVO now offers the broadest respiratory syncytial virus (RSV) protection in the EU, covering adults aged 18 and older, as well as infants up to six months through maternal immunization.

3) Further expanding the respiratory syncytial virus (RSV) vaccine pipeline, Clover Biopharmaceuticals received FDA clearance on March 23, 2025, to initiate a Phase I clinical trial for its candidate SCB-1019. The trial specifically aims to assess booster efficacy in older adults previously vaccinated with GSK’s AREXVY. Additionally, Clover plans to launch a 2025 trial for a combination vaccine targeting respiratory syncytial virus (RSV), human metapneumovirus (hMPV), and potentially parainfluenza virus 3 (PIV3), following encouraging comparative data between SCB-1019 and existing respiratory syncytial virus (RSV) vaccines.

4) In another breakthrough, AIM Vaccine submitted an Investigational New Drug (IND) application to the FDA on February 10, 2025, for its novel mRNA-based respiratory syncytial virus (RSV) vaccine candidate. Preclinical results suggest superior immune responses compared to international marketed mRNA respiratory syncytial virus (RSV) vaccines, positioning AIM as a potential frontrunner in the next generation of respiratory syncytial virus (RSV) immunization strategies.

These developments collectively mark a transformative period in respiratory syncytial virus (RSV) prevention, underscoring how vaccine innovation and strategic clinical trials are reducing disease burden and redefining respiratory disease management across age groups.

Future Outlook: Transforming the Respiratory Syncytial Virus Treatment Market

The Respiratory Syncytial Virus Treatment market is expected to witness rapid growth driven by innovations in vaccines and monoclonal antibodies. Injectable therapies will continue to dominate due to their high clinical effectiveness and premium pricing, with new combination vaccines and expanded indications broadening their reach. Companies are intensifying clinical trials to develop next-generation vaccines and long-acting monoclonal antibodies, targeting wider age groups and high-risk populations.

The growing acceptance of maternal and adult respiratory syncytial virus (RSV) vaccines, alongside passive immunity from advanced mAbs like Beyfortus, will fuel market expansion. Meanwhile, oral antivirals are poised for steady uptake, supported by improved formulations that enhance patient convenience and adherence.

Technological advances, coupled with regulatory support and strategic partnerships, will drive faster approvals and cost efficiencies. By 2030, respiratory syncytial virus (RSV) therapies are projected to become more accessible and integrated into routine care, significantly reducing the global disease burden and transforming preventive and therapeutic approaches across diverse patient populations.

Key Competitors:

- Moderna

- Sanofi

- GSK

- AstraZeneca

- Enanta Pharmaceuticals, Inc

- Novavax

- BlueWillow Biologics

- Other Prominent Players

Market Segmentation Overview

By Drug Type

- Vaccines

- Abrysvo

- Arexvy

- MRESVIA

- Monoclonal Antibodies

- Synagis

- Beyfortus

- Antivirals

By Dosage Forms

- Injectables

- Orals

- Antivirals

By Geography

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Need More Info? Ask Before You Buy: https://www.astuteanalytica.com/inquire-before-purchase/respiratory-syncytial-virus-market

About Astute Analytica

Astute Analytica is a global market research and advisory firm providing data-driven insights across industries such as technology, healthcare, chemicals, semiconductors, FMCG, and more. We publish multiple reports daily, equipping businesses with the intelligence they need to navigate market trends, emerging opportunities, competitive landscapes, and technological advancements.

With a team of experienced business analysts, economists, and industry experts, we deliver accurate, in-depth, and actionable research tailored to meet the strategic needs of our clients. At Astute Analytica, our clients come first, and we are committed to delivering cost-effective, high-value research solutions that drive success in an evolving marketplace.

Contact Us:

Astute Analytica

Phone: +1-888 429 6757 (US Toll Free); +91-0120- 4483891 (Rest of the World)

For Sales Enquiries: sales@astuteanalytica.com

Website: https://www.astuteanalytica.com/

Follow us on: LinkedIn | Twitter | YouTube

CONTACT: Contact Us: Astute Analytica Phone: +1-888 429 6757 (US Toll Free); +91-0120- 4483891 (Rest of the World) For Sales Enquiries: sales@astuteanalytica.com Website: https://www.astuteanalytica.com/