Battery Production Machine Market to Reach USD 19.67 Billion by 2032, Driven by the Rising Demand for Electric Vehicles and Renewable Energy Storage | SNS Insider

Battery Production Machine Market growth is driven by surging EV demand, renewable energy storage needs, and automation in battery manufacturing processes.

Austin, June 02, 2025 (GLOBE NEWSWIRE) -- Battery Production Machine Market Size & Growth Insights:

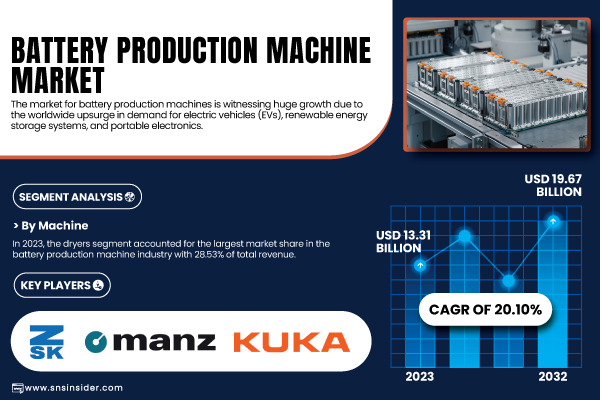

According to the SNS Insider,“The Battery Production Machine Market was worth USD 13.31 Billion in 2023 and is anticipated to reach USD 19.67 Billion in 2032, growing at a CAGR of 20.10 % during the period from 2024 to 2032.”

Accelerating Growth of Battery Production Machines Driven by Electric Vehicle and Energy Storage Demand

The battery making machine market is growing rapidly due to the rising adoption of electric vehicles (EVs), renewable energy storage, and portable electronics. Coating, drying, stacking, slitting, and forming equipment is used in jetting thin film and roll-to-roll manufacturing, is compatible with virtually all materials, and eliminates need for costly broaching and EDM work. Inside market data for the U.S: The market size followed an increasing trend in the U.S. with a value of USD 8.68 million in 2023 and is estimated to reach USD 12.27 million by the end of 2032 with the CAGR of 3.96%. Local investments in EV production, grid modernisation, and energy storage infrastructure, along with government incentives and partnerships, may fuel such growth. The proliferation of lithium-ion and next-generation solid state batteries in giga factories is also driving demand for scalable, automated and precise manufacturing equipment.

Get a Sample Report of Battery Production Machine Market Forecast @ https://www.snsinsider.com/sample-request/6732

North America Leads Battery Production Machine Market While Asia Pacific Exhibits Fastest Growth

In 2023, North America dominated the battery production machine market with a 37.40% revenue share, on account of high electric vehicle production, energy storage investments, and strong government support for domestic battery production. The U.S. is leading the way and companies including Tesla, Ford and General Motors are working with machine suppliers like Wuxi Lead and Duerr to create robotic gigafactory lines. The Local Production Gurantee Act stimulates additional local production investments, creating demand for precision coating, stacking and drying equipment.

Asia Pacific is forecasted to register the highest CAGR of 6.45%, can be attributed to increasing battery manufaturing facilities in China, South Korea and Japan. Leading players CATL, LG Energy Solution and Panasonic are investing on high-end, AI-based manufacturing technologies to cater to increasing demand for EVs and energy storages, rendering Asia Pacific to be the fastest-growing regional market.

Battery Production Machine Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 13.31 Billion |

| Market Size by 2032 | USD 19.67 Billion |

| CAGR | CAGR of 20.10% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | •By Machine – (Slitting machines, Laminators, Stackers, Dryers, Formers) •By Battery -(Lithium-ion batteries, Lead-acid batteries, Nickel-cadmium batteries, Nickel-metal hydride batteries, Flow batteries) •By Application – (Automotive industry, Consumer electronics, Energy storage, Marine applications, Medical devices) |

Purchase Single User PDF of Battery Production Machine Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6732

Battery Production Machine Market Insights: Leading Segments by Machine, Battery Type, and Application in 2023

By Machine

In 2023, dryers led the battery production machine market with a 28.53% share, as moisture extraction is essential in improving battery performance and keeping them in working condition for long period. Players Duerr Group and Hitachi Zosen have entered the market with vacuum-based drying systems, including Durr’s ecoDry, to cater to growing demand for lithium-ion batteries.

The stackers segment is set to grow fastest at a 7.24% CAGR, on account of automation and AI facilitated precision layering in battery assembly, aided by notable innovations from Manz Autom. AG and Shenzhen Yinghe Technology.

By Battery

In 2023, lithium-ion batteries dominated the battery production machine market with a 63.20% revenue share, driven by soaring demand from EVs, consumer electronics, and energy storage. Leading companies like Tesla and Panasonic expanded gigafactories, while manufacturers such as Wuxi Lead and Manz Autom. AG introduced automated, high-throughput equipment.

The flow batteries segment is expected to grow fastest at a 7.85% CAGR, fueled by rising utility-scale renewable energy storage needs and advancements from ESS Inc. and Invinity Energy Systems in modular stack and electrolyte handling machinery.

By Application

In 2023, the automotive sector led the battery production machine market with a 41.50% revenue share, due to the increasing EV production worldwide and expansion of gigafactories by Tesla, Ford, and Volkswagen . Collaborations with equipment manufacturer partners such as Duerr and Siemens are driving automation of lithium-ion battery production.

The consumer electronics segment is set to grow fastest at a 6.55% CAGR, fueled by demand for miniaturized, high-energy batteries in smartphones and wearables, with companies like Panasonic and Manz Autom. AG developing precision manufacturing technologies.

Leading Market Players with their Product Listed in this Report are:

- LG Energy Solutions Ltd.

- Saft Groupe SA

- Gelion PLC

- Sion Power Corporation

- Johnson Matthey

- Giner Inc.

- Lynntech Inc.

- Ilika Technologies

- Williams Companies Advanced Engineering

- Guang Dong Xiaowei New Energy Technology Co. Ltd.

Do you have any specific queries or need any customized research on Battery Production Machine Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6732

Recent Developments:

- In April 2024, Manz Autom. AG divested Tesla Automation including Greatech as well as its Asian subsidiaries in the context of the insolvency, and the income was entered to the estate.

- In Jul 2024, Kuka obtained an order worth millions for the delivery of 23 friction stir welding systems for EV battery assembly, which enables to join mixed materials energy-efficiently and precisely.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Battery Production Machine Market Segmentation, by Machine

8. Battery Production Machine Market Segmentation, by Battery

9. Battery Production Machine Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)