BlackBerry Ltd (NASDAQ:BBRY): Crisis Keeps Growing

BlackBerry Ltd (NASDAQ:BBRY) started a software transition after the declining smartphones sales but analysts fear that the business transformation is going nowhere. Blackberry’s hardware sales are also declining. Goldman Sachs recently recommended investors to sell Blackberry stock as it expects the Canadian company’s software sales to fall amid a tough competition from giants like Microsoft , VMWare and Citrix .

Solaris Asset Management’s Tim Ghriskey also said in a latest report that Blackberry has very bleak chances of making an impact in the futuristic domains like driverless cars and IoT.

Blackberry recently lost major contracts from the Canadian government after a big federal agency decided to use Samsung smartphones instead of Blackberries.Over the current book year the total revenue will be 917,87 million USD (consensus estimates). This is rather significant more than 2016's revenue of 1,31 billion USD.

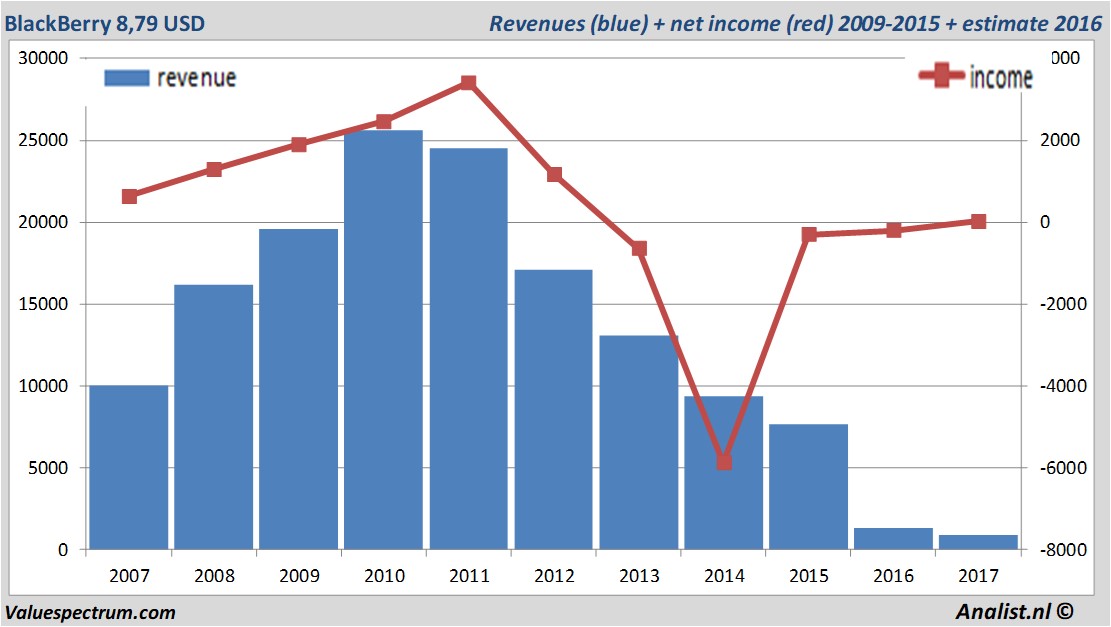

Historical revenues and results BlackBerry plus estimates 2017

The analysts expect for 2017 a net profit of 22 million USD. According to most of the analysts the company will have a profit per share for this book year of 4 cent. So the price/earnings-ratio equals an extreme 219,75.

For this year analysts don't expect the company to pay a dividend.The average dividend yield of the telecommunications companies equals a low 0,93 percent.

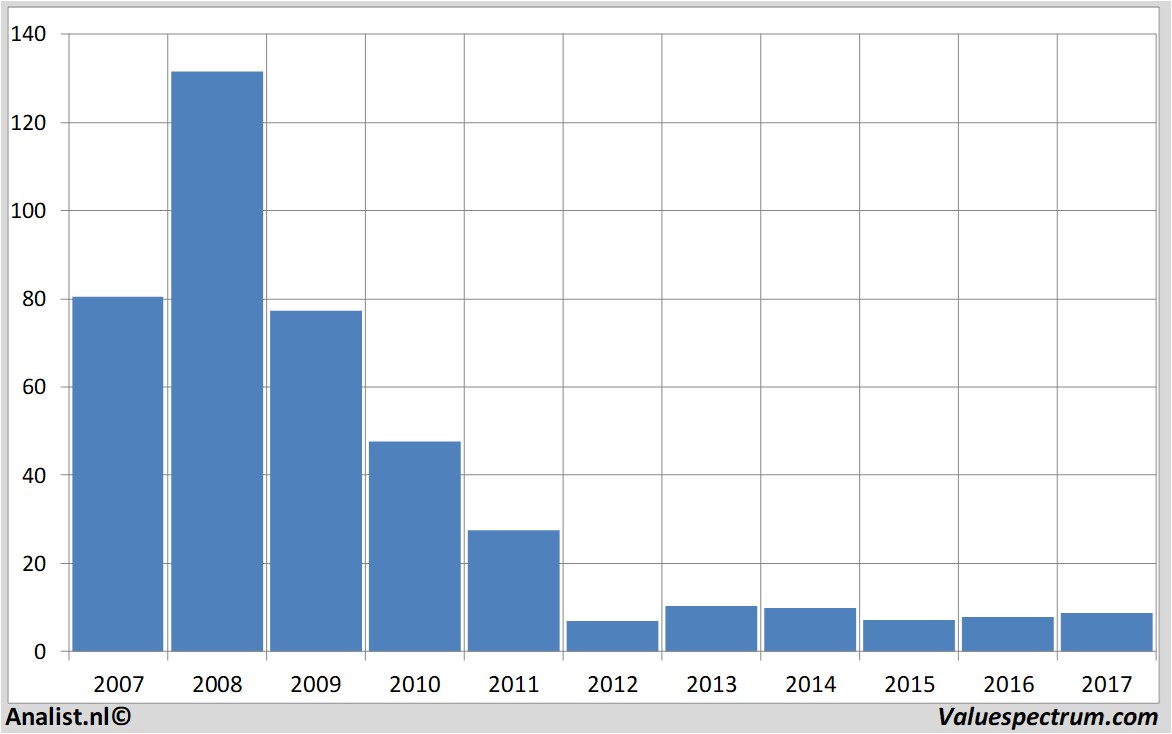

BlackBerry 's market capitalization is based on the number of outstanding shares around 4,58 billion USD.Price data BlackBerry 2007-2017

At 16.31 the stock trades 0,17 percent lower at 8,79 USD.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.