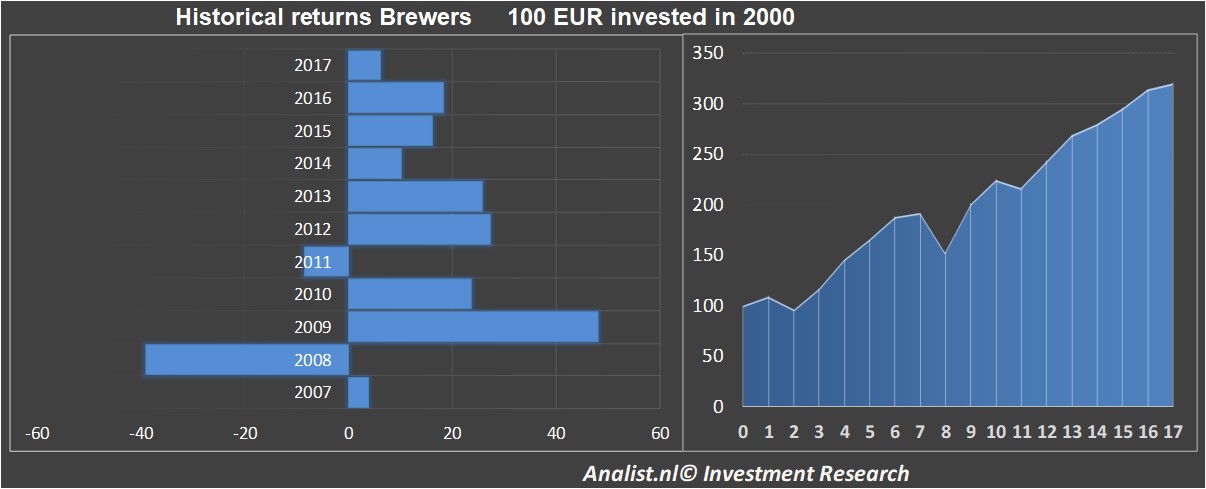

Losses for brewery sector

Lately most stocks of the brewery sector are under selling pressure. Over the past 3 months the sector is 18,48 percent lower. Investors who bought the average share of the sector in 2000 now have a stunning profit of around 320 percent. Since 2012 the sector trades 102 percent higher. On average the sector yields a quite high dividend yield of 2 percent.

Returns brewery sector

The European brewers are in terms of their price/earnings ratios cheaper than the US ones. Per European share investors pay now less the for the expected earnings per share. So it seems the markets expect less growth of them. The whole sector now trades at a quite huge CAPE-ratio of 30. Constellation Brands , Heineken are AB AB InBev are among the top CAPE-ratios. Carlsberg , Molson Coors Brewing are Brewin Dolphin Holdings among the ones with the lower CAPE-ratios. The European brewery sector has a CAPE of 8 and the US's sector of 5. Both the US and the European sector gained the past 12 months.

The EU stocks in this sector are around 8 percent higher and the US's are 5 percent higher.

The European brewers now deliver more dividends then the US ones. These in Europe now yield 2,06 percent and these in US 0,6 percent. 0, 0 and 0 have now the highest dividend returns (in case the dividends per share are unchanged).

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.