Megacaps are the best in industrial metals sector

Within the large caps, we see a low diversification of the 12-months returns. Since July last year the sector is around 4 percent lower. Among the winners we find Trans-Siberian Gold, Alacer Gold and Acacia Mining. Relatively big losses were for Nyrstar NV, Ferroglobe and Firestone Diamonds.

Core figures large caps

The megacaps in this sector are the winners. Among the less performing are mostly the smallcaps.

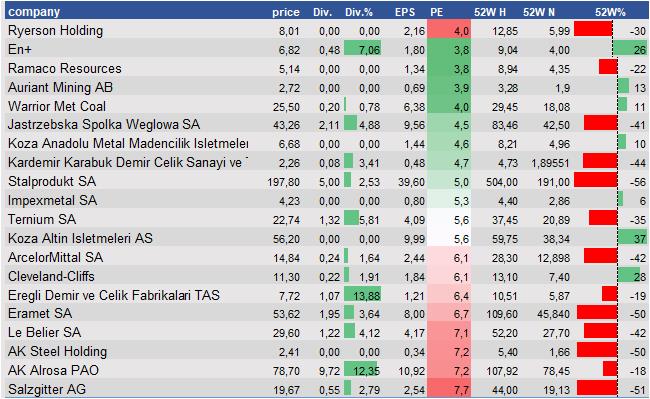

Lowest PE-ratios large caps

Regarding the price/earnings-ratios we see a diversified palette. The megacaps are with the price/earnings-ratio of 703 the most expensive. The smallcaps are the cheapest and trade at 11 times the earnings per share. Tharisa, Chamberlin and Hochschild Mining are the stocks with the highest ratios. Stocks with the lowest ratios are Ryerson Holding, En+ and Ramaco Resources.

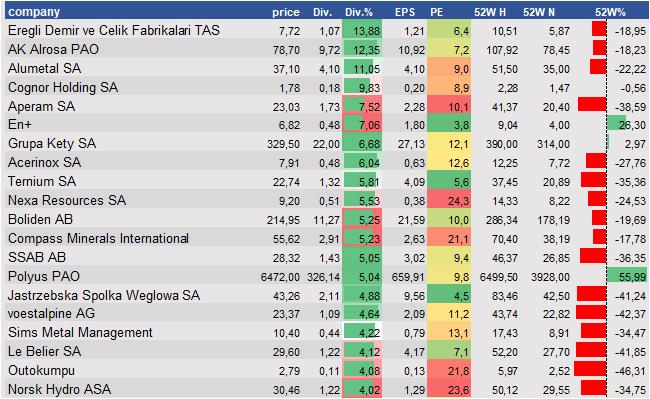

Highest dividend yields large caps

The sector's average dividend yield is with 1,6 percent relatively high. Stocks now high dividend yields now are Eregli Demir ve Celik Fabrikalari TAS, AK Alrosa PAO and Alumetal SA.

This is a free publication from Valuespectrum Pro. Valuespectrum Pro is a professional platform with analyses from all US and European companies. Click here to sign up for free.