Large caps most expensive in real estate sector

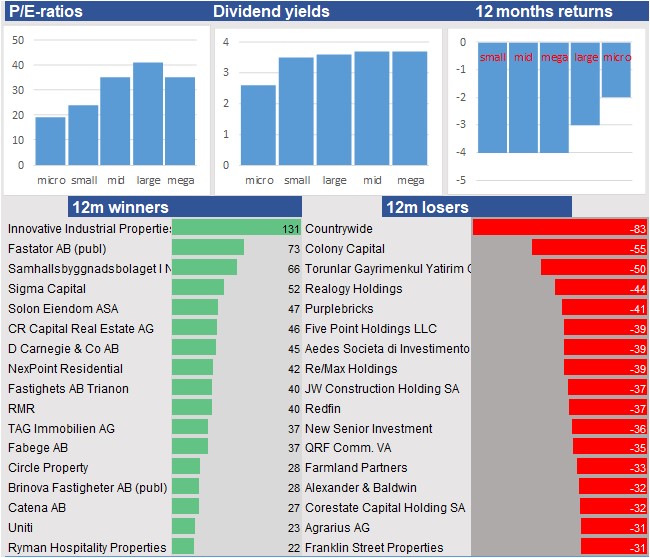

Within the real estate sector we see a low diversification of the 12-months returns. Since October last year the sector is around 3 percent lower. Among the winners we find Innovative Industrial Properties, Fastator AB (publ) and Samhallsbyggnadsbolaget I Norden AB. Relatively big losses were for Countrywide, Colony Capital and Torunlar Gayrimenkul Yatirim Ortakligi AS.

Core figures real estate sector

The microcaps in this sector are the winners. Among the less performing we see mostly the smallcaps.

Lowest PE-ratios real estate sector

Regarding the price/earings-ratios we see a diversified palette. The large caps are with the price/earnings-ratio of 41 the most expensive. The microcaps are the cheapest and trade at 19 times the earnings per share. Alexander & Baldwin, Merlin Properties SOCIMI SA and Chesapeake Lodging are the stocks with the highest ratios. Stocks with the lowest ratios are Torunlar Gayrimenkul Yatirim Ortakligi AS, Fastator AB (publ) and I2 Development SA.

Highest dividend yields real estate sector

The sector's average dividend yield is with 3,4 percent relatively high. Stocks with now high dividend yields are Uniti, Selvaag Bolig ASA and New Senior Investment.

This is a free publication from Valuespectrum Pro. Valuespectrum Pro is a professional platform with analyses from all US and European companies. Click here to sign up for free.